Exchange of properties – We are going through an extremely delicate moment for everyone. Isolation, the Home Office, the reduction of costs and salaries, fear, etc.

In everyday life, being at home meant coming home from work, taking a shower, having dinner, spending a little time with the family in the living room and then going off to rest and the next day, everything again. On the weekends, there is usually something to do, football to watch, a series, on a trip, a visit from some family, etc.

During the pandemic, this changed. Having to stay at home, with the whole family, without being able to go out and more… working from home. Nobody was prepared for this! Few, if not rare, had a study area or an office where they could work in peace.

See also: First apartment: 17 tips for buying yours.

Living during the pandemic

So, thinking about this new coexistence – being with your children, wife and sometimes your pet full time – made many people rethink their lifestyle.

Therefore, there was also an impact on the real estate sector. Many began to realize that there was a lack of space for everyone in the family in their property… This was because it was not always necessary for everyone to be in the property for so long, or even the possibility of remaining working from home, even after the end of the pandemic, which has become a reality for many companies. Therefore, you will need a new way to organize your home or even carry out a renovation.

However, many people realized that in their properties, there is no space for studies or work. In the same way, it was also noticed the difference that having a balcony makes, to simply look outside or see the blue sky, in the case of apartments.

All this because we respect the obligation to collect and wait. It was an arduous 90 days for most families and at that moment, many of them decided that changes were necessary. But how can I move house if I need to sell mine to be able to buy another one? Could this take months, if not years?

Exchange Idea

Hence the idea of exchange of real estate started to get stronger. The change would be less burdensome on the family budget and would speed up the entire moving process.

Let’s look for brokers who do this, the families thought.

Once total isolation ended, calls to real estate agencies started pouring in! July was a historic month for many of them. Customers crazy about a business called “Exchange“.

But, as we already know, the word exchange means “Exchange”. Exchange one property for another.

But to exchange it, you need to think about the following: I have a property and I want to exchange it for another. It should be part of the payment and the remainder paid with my savings resources or I take out financing.

But then comes the disappointment! It’s not as easy as we imagine.

Points to take into consideration

Those who sell do not always accept another property as part of the payment;

Those who accept a property as part of payment cannot always accept yours. Whether for reasons of location, aesthetics or even because the value is very close to what you want to exchange.

However, to illustrate, we will consider a favorable scenario where the parties meet, the two properties are of interest to each other and thus, their owners decide to sit down to negotiate.

Documents

If you are giving your property as part of the payment, first of all, as in any real estate negotiation, you must be fully aware that not all properties have the same documentary conditions as yours.

Therefore, it is necessary to assess whether all documents, taxes and property structure are correct. If you are going to take out financing, this is a little easier, as the bank will carry out these analyzes before releasing real estate credit to those who need it.

Find out more at: Why is having a regularized property good? Do you know what it means to have a regularized property? In addition to the various benefits that this action can bring you, not having it can generate fines and unforeseen events, especially for those who intend to sell or rent the property. Find out everything about how to regularize, as well as the advantages and disadvantages!

Costs

Assuming everything is in order, it is important to remember, especially for those who receive another property as part of payment, that in addition to the documentation in order, you will have costs for registering the property and transferring it to your name. Since so far it is in someone else’s name.

If this exchange is for personal use, that’s fine, as we know that this will happen in one way or another when you buy a new property. But if you take the property to resell, this has to be taken into consideration too! Since the value of the business will be deducted from the registration costs and also the fees of the real estate agency or broker who will sell it later. We are talking about approximately 10% to 15% of the original value of the property.

Exemplifying the situation

In a negotiation I am selling my apartment for R$1,000,000.00. The interested party has another apartment worth R$500,000.00 and wants to give it as part of the payment. I’m going to take this property to resell it later, as I’m not interested in living in it. Hence the prank.

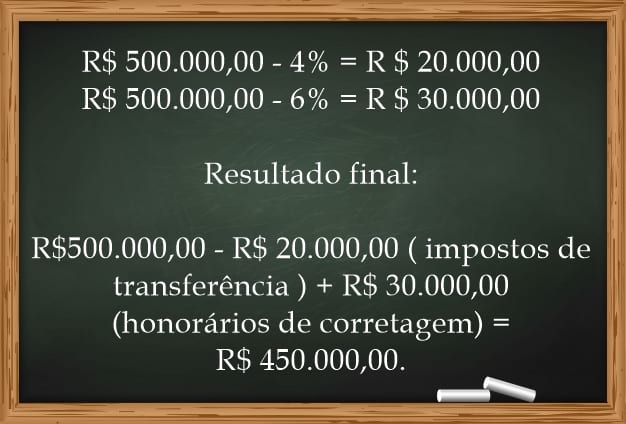

Considering that the property has an adjusted market value of R$500,000.00, how am I going to put it up for sale considering that I will have to pay 3% to 4% of the market value to register it and transfer it to my name? What’s more, I will still have to pay the 6% brokerage fee when it is sold. Did you do the math? Do you know how much would be left over from a R$500,000 property? I show you:

Therefore, if you didn’t already give a discount on the initial transaction, you already made a loss of R$50,000.00. Therefore, you ended up selling your property for R$950,000.00 and not for R$1,000,000.00.

Risk-free exchange

Before accepting a property as part of payment, evaluate its purpose for you. Assess your market value, this is very important! Consult other brokers and real estate agencies who are outside the negotiation. Look for similar ads, there is always another apartment for sale in the same building or a house in the same neighborhood.

In summary, the exchange despite being a little more laborious, it is an option that makes life easier for those who are selling and those who are buying. This is an increasingly common practice in the real estate market and has generated a large number of businesses.

But, on the other hand, it is extremely important to be accompanied by a good broker who will always professionally guide both parties so that the business is advantageous and does not cause harm to anyone.

Buying and selling property only with an accredited broker, require CRECI from the professional who assists you, it is his duty to present it to you and your right to ask.

Research, evaluate, analyze and always keep in mind that a deal is only good when all parties are satisfied!

Finally, see also: How to decorate a small apartment for men.

By Douglas Matias da Silva

(11) 98277-0901

CRECI 172037

Bia, Davi and Isa are on the 20th Paredão! On Thursday, another one of them says goodbye to the house; Which brother do you think will leave the program? Participate in the vote in the Fashion Bubbles poll and check partial results in real time!

Sign up for our newsletter and stay up to date with exclusive news

that can transform your routine!

Warning: Undefined array key "title" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 12

Warning: Undefined array key "title_tag" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 13