Cheap flights to Peru, Turkey So it is absolutely essential to get travel insurance! Read on to explore the excellent insurance options, perfectly adapted to different types of trips, such as backpacking, adventures and more. In addition, we have two FREE TOTAL travel insurance alternatives, which can be new to you!

Rescue of staff trekking in South Korea

A journey to Peru can provide wonderful moments, but it can also generate some stress. Among the tasks of dealing with air tickets, lodging reservations, planning activities and itineraries, in addition to preparing for jet lag, many travelers end up neglecting a crucial detail: hiring a travel insurance.

If you identify with this situation, don’t worry! Read on to find out all about the importance of getting travel insurance to Peru, including a list of the best and most economical options available!

But before we proceed…

Do I need travel insurance to go to Peru?

Unquestionably, quality travel insurance is absolutely essential, especially for travelers like me, who indulge in activities at high risk of injury (and, consequently, medical expenses!).

During my journeys, I’m adept at climbing mountains, exploring challenging places, practicing jumping and swimming in unusual places – basically, I embrace everything I consider part of a perfect adventure!

Imagine snowboarding in Switzerland without travel insurance, getting hurt in the middle of the mountain and need a helicopter evacuation. The medical bill you would receive while lying in bed in the hospital would have so many zeros that could cause heart problems just by looking at it!

Having a travel insurance is a sensible measure no matter where you go!

In addition, during my wanderings, I met several backpackers who exhibited the infamous “Thai tattoo”, which are giant scars on the legs caused by motorcycle exhaust burns in Thailand!

After all, who would want to end up in a public hospital in the middle of Bangkok? With travel insurance, you can choose to be treated in a private hospital where you are likely to receive better quality care. Therefore, it is one more reason not to give up insurance before your next adventure!

Do I really need travel insurance? I do not play sports or extreme activities!

Here’s the crux: Even if you’re just planning to shop in Miami, it’s of paramount importance to have travel insurance.

There is always some kind of risk on any trip, even when walking on the street and suffering a fall or getting sick.

Relying exclusively on the health system in Peru (or in many other countries) without any type of insurance is like exposing yourself to a possible financial ruin.

In addition, many countries, including Peru, require travelers to have some type of health insurance or travel in order to enter the country.

Also remember that travel insurance is not limited to health problems or doctors. Depending on the plan you choose, it can assist in covering expenses with lost baggage, flight delays, problems caused by adverse weather conditions and even the evacuation of the country in case of civil unrest. Therefore, it is a prudent investment to ensure a smooth and safe trip, regardless of the destination and planned activities.

Update on Travel Insurance and the Coronavirus (COVID-19)

It is true that the Covid-19 pandemic has not yet been completely eradicated, and it is understandable that people are concerned about the coverage of travel insurance related to this disease.

Currently, most travel insurance plans offer coverage for Covid-19-related expenses. However, it is strongly recommended that you thoroughly review the details of your policy prior to making the purchase in order to ensure that you have adequate coverage for possible eventualities related to that disease.

Insurance terms and conditions may vary, so it is important to understand what are the exclusions or restrictions related to Covid-19, if any. By doing so, you will be better prepared and protected if you face any health problems during your trip.

Remember that the situation of the pandemic can change rapidly, and insurance policies can also be adjusted accordingly. Therefore, keep up to date on the changes and be well informed about the conditions of your insurance before you travel. With the appropriate coverage, you will be able to enjoy your trip with more tranquility and security.

(OO which for more details, you can also take a look at our article here: International Health and Travel Insurance covers the Coronavirus (COVID-19)?)

How does Peru’s health care system work?

Peru’s health system is composed of two main parts: the public health system (also known as EsSalud) and the private health system. Let’s explore each of them:

Public health system (EsSalud): EsSalud is the public health system of Peru, which provides medical and hospital services to formal workers and their dependents. It is funded by compulsory contributions from employers and employees. Peruvian citizens who formally work and are in a regular employment situation have the right to enroll in this system and receive medical, surgical, dental and other health services. Service in the public system can be more accessible in terms of costs, but quality can vary depending on the region and the availability of resources.

Private health care system: Peru also has a private health system that offers medical and hospital services to those who can pay for them or have a private health insurance. The private system is often considered to be of best quality and offers a greater variety of services and facilities. Hospitals and private clinics often have modern equipment, medical specialists and greater comfort, but the costs are significantly higher compared to the public system.

Foreign tourists can also access both the public system and the private health system in Peru. However, it is highly recommended that travelers take out travel insurance that covers medical and hospital expenses to avoid possible financial surprises in case of health emergencies during the trip.

It is important to note that the quality and availability of health services may vary depending on the region of Peru, being generally better in large cities and popular tourist destinations. In rural and remote areas, medical resources may be more limited, and transportation for specialist care can be more challenging.

Note: The options mentioned above are directed to travel insurance intended for tourists. However, if you are planning to go to Peru with the aim of studying, you will need to acquire an international health insurance plan for foreign students. On the other hand, if you are moving to Peru as a worker or immigrant, a health insurance policy for expatriates will be required. Some alternatives to these cases can be found at the bottom of this article.

What are the best travel insurance for Peru?

If you conduct an online search on travel insurance, you will find a wide variety of options.

However, over the years, I have conducted a comprehensive survey of travel insurance companies (and have also tried several of them!). The following list includes travel insurance options that always return.

However, it is important to remember that your final choices will depend on your location and the level and type of coverage you desire for your trip.

I recommend taking the time to get a quote from each of these companies for your trip. I know it may take some time, but the money you can save at the end of the day will be worth it!

Following are the travel insurance comparison sites that allow you to compare and acquire different planes.

1. The largest and cheapest travel insurance portal in Brazil to compare and guarantee the best price:

Promo Insurance (cupom 5% discount OUTCOMF5)

Seguros Promo does not act as an insurer in itself, but rather as an aggregator platform that provides and markets travel insurance over the internet. Through its tool on the website, travelers have the possibility to compare coverage and prices of different companies and select the travel insurance that best suits their needs. In addition, Promo Insurance offers assistance in case of claims, intermediating the customer’s contact with the insurer.

It is recommended that, in addition to researching WorldNomads, mentioned above, the user also explores the Promo Insurance website to find other options of companies and travel insurance plans especially aimed at Brazilians.

In Promo Insurance, you can find several travel insurance options at very advantageous prices. Some of the most economical travel insurance to Peru were found there.

However, it is important to pay attention to the value of the coverage offered by these insurances. For example, the health care system in the U.S. has high costs, so a coverage of $30,000 would be considered low for travel to that country. On the other hand, the minimum coverage required for the Schengen area in Europe is 30,000 Euros, which currently corresponds to about US$ 33,000. Therefore, the choice of proper coverage will depend on the destination of the trip.

In the case of playing sports or adventure activities during the trip, it is crucial to verify that the contracted insurance offers adequate coverage for these activities, in addition to analyzing the total amount of coverage provided.

An important detail is that Insurance Promo also offers travel insurance with worldwide coverage. If the traveler plans to visit more than one continent during his journey, he can take out a single comprehensive insurance by selecting “international” as a destination. For example, when traveling to Asia and Europe, it is possible to purchase insurance that covers both continents, provided that the coverage exceeds 30,000 euros or US$50,000 (minimum amount required for the Schengen Area). In this way, the traveler will be protected for both continents. The same applies to three or more continents.

In addition, it is recommended to check if travel insurance includes coverage for dental treatment, since some plans offer this coverage while others do not.

As for the payment, Promo Insurance offers the option of installment within 12 times the credit card without interest or grants 5% discount on the purchase with payment via boleto or PIX.

And on top of that 5% of the ticket, there is still a 5% discount Coupon to use in Promo Insurance. Discount code: OUTCOMF5.

Therefore, take a search in Promo Insurance just to take the proof and, finding a cheaper price, hire with themselves!

Some of the insurance offered by Promo Insurance:

Promo Insurance Travel Insurance and COVID-19 coverage

Seguros Promo is an insurance comparator site and therefore does not offer direct coverage in cases of occurrences. Among the insurers available on the platform, only Assist Card, Travel Ace and Intermac provide emergency care in situations of suspected Coronavirus. Other companies offer coverage only until the time the disease is diagnosed. It is essential to thoroughly check the details of the coverage of each plan before making the appropriate choice to your needs during the trip.

Meet the Brazilian Travel Insurance that Cobre COVID-19 here.

2. 2. The other Brazilian travel insurance portal option with great prices:

Real Travel Insurance (link with 17% discount on Real Seguro17)

Another Brazilian travel insurance sales platform similar to Promo Insurance is Real Travel Insurance. Like Promo Insurance, they are not an insurer itself, but act as an intermediary to market travel insurance from other companies.

In addition to offering a wide variety of travel insurance, Real Seguro Viagem also stands out for its highly competitive prices! On some occasions, I came across travel insurance in Real Seguro Viagem that were identical to those of Promo Insurance, but with lower values. Or, still, I found the same travel insurance offered by Insurance Promo at the same price, but with greater coverage in Real Seguro Viagem. Thus, I consider it worth investing only 5 minutes to request a quote in Real Travel Insurance and check if you can not find a more advantageous option there.

Note: The tips on the value of coverage, sports, dentist and payment in Real Seguros are similar to Promo Insurance.

Travel Insurance Insurance and Coronavirus coverage

Currently, all necessary medical expenses are covered by the partner insurers of Real Seguros until the moment the COVID-19 is diagnosed. However, if the patient is diagnosed with the disease, treatment related to COVID-19 will no longer be covered by companies, since pandemics are usually listed as excluded risks in the insurance policies.

3. The option of well-known insurance company and average price:

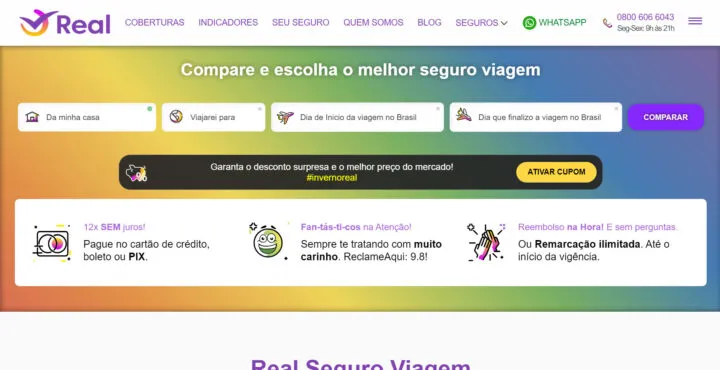

IMG Global (accepted citizens of all countries!)

The International Medical Group (IMG) is, in fact, a renowned insurance company in the United States that offers travel insurance for travelers from more than 190 countries.

In this way, regardless of its location, IMG is an excellent option to find travel insurance to Peru!

They have a travel insurance plan available only to Americans (Patriot Travel Medical Insurance) and another one available to non-U.S. travelers (Patriot America Plus).

You have the flexibility to choose the desired coverage level, ranging from $50,000 to $500,000, and deductibles can range from $0 to $2,500.

The prices offered are generally competitive. However, as well as some of the other options mentioned above, there are some activities that are not included in coverage. Therefore, it is strongly recommended to carefully read the policy to ensure that it includes all necessary coverage before finalizing the purchase.

Travel insurance for seniors (65+): One thing that makes IMG unique is that they offer a tailor-made travel insurance plan for travelers 65 and older, called GlobeHopper Senior.

IMGlobal travel insurance and coverage for COVID-19

In general, most of the plans offered by IMG will provide coverage for all Covid-19-related care you may need, including treatment, hospitalization and even medical evacuations. However, it is crucial to carefully read your policy before making the purchase, to check if there has been any changes in coverage.

4. 4. The best and most comprehensive travel insurance for backpackers and adventurous travellers:

(5% discount coupon: comfort5comfort5)

In my opinion, World Nomads is the best travel insurance company available for backpackers.

Whenever I am traveling in areas where I plan to carry out more adventurous activities or considered “risky” (such as snowboarding, canyoning, glacier hiking, skiing, skiing, climbing, etc.), I make sure to acquire a policy with World Nomads.

They actually cover almost all activities, and to date, I haven’t found another company that offers a better deal for ALL activities covered by World Nomads policies. (If you know any other please let me know in the comments below!)

If you have a specific activity in mind and want to know if it will be covered by World Nomads, you can check this page here.

Essentially, there are two types of policies that you can choose from with World Nomads. The first is the “Standard” policy. Even if you have some adventure activities planned, the “Standard” option may still be enough as it offers emergency medical coverage for activities such as alpine skiing or hiking of up to 6,000 meters (almost 20,000 feet)!

Otherwise, you also have the “Explorer” plan, perfect for more adventurous travelers. This plan will cover almost any other activity imaginable. (But of course, double-check your plan before buying, if you have something specific in mind that you want to cover.)

Another interesting feature of World Nomads is the possibility of adding optional coverage for “high-value specific items such as iPhones and digital cameras.” If you are traveling with a lot of electronic equipment or in areas where theft is common (like my home country, Brazil, for example), this can be a smart option.

I can also add that based on my personal experience when seeking reimbursement after falling ill in Thailand, the World Nomads customer service team is very attentive and easy to handle.

Another important thing to know is that with World Nomads, you can buy your travel insurance even if you have already started your trip. You do not need to be in your country of residence to buy or extend a policy.

You can get a 5% discount code on your World Nomads travel insurance policy using the coupon code “comfort5.”

(P.S. If you are like me and you are also addicted to sports and adventure activities and wish to have good travel insurance that covers them, here are two other items you might like: 3 Best International Travel Insurance for Extreme Sports and Adventure Activities and 9 tips to stay in shape during your travels.)

WorldNomads travel insurance and COVID-19 coverage

Until the date of this publication, World Nomads does not provide clear information as to whether its insurance plans cover the treatment of COVID-19. However, in order to get the most up-to-date information on coronavirus-related coverage, it is recommended to check directly on its website at this link.

5. . 5. One of the cheapest travel insurance companies you will find out there:

WorldTrips (formerly Atlas Travel)

According to my experience, WorldTrips travel insurance plans are usually some of the most economical in the market. However, it is important to note that due to the affordable price, they may not offer as much coverage as companies like World Nomads.

For this reason, I often opt for WorldTrips when I travel to destinations considered more “safe”, mainly cities such as the United States or Europe.

Although I have purchased WorldTrips travel insurance plans before, fortunately I never had to request a refund. Therefore, I cannot say with certainty what the refund process is. However, I found some comments from other people who have done it and managed to get reimbursement successfully. It seems that WorldTrips is a great option for budget travelers looking for cheap travel insurance.

In general, WorldTrips accepts citizens from all over the world, with a few exceptions. They offer plans of different sizes and types, from backpacking trips around the world for a full year to short study trips abroad for college students.

An interesting feature of WorldTrips is that you can buy a policy even after you have already started your trip. Therefore, if you are already abroad and want to acquire or extend a plan, there is no problem.

Unlike many other insurance companies, WorldTrips imposes no age limit! However, it is important to mention that the price of the plan will increase as the price of the plan will increase as age. Also, when you are over 70 and then 80 years old, coverage limits can decrease. Therefore, it is natural that older people pay more than young people for the same coverage.

It’s rare to find travel insurance companies that offer coverage for seniors, making WorldTrips a solid choice for travel insurance in this age group!

WorldTrips Travel Insurance and Coverage for COVID-19

In general, the medical costs related to COVID-19 disease will be covered by your WorldTrips policy. However, it is essential to check your policy details to ensure that coverage is up to date before making the purchase.

6. . 6. One of Brazil’s Best International Travel Insurance

Allianz Assistance / Mondial Travel

I should also mention Allianz/Mondial, as many readers have recommended this travel insurance. Allianz Brasil’s international travel insurance website is customized for Brazilians, offering all the details in Portuguese and with customer service in Brazil.

If you feel more comfortable using local business English sites, Allianz is a great option, as well as offering very competitive prices. They also offer multi-destination annual travel insurance!

Despite generally attractive prices, it is essential to check the “general conditions” to ensure that this insurance meets your needs as it may not cover all the activities you plan to perform.

They make installment in 6 x on the credit card for purchases over R$ 120.00.

Allianz Travel Insurance and COVID-19 coverage

The insurer does not cover the treatment of COVID-19. Your expenses will only be paid until the time of diagnosis of the disease.

7. 7. The new international travel insurance company for digital nomads and adventure sports and extremes:

Safety Wing

Safety Wing has gained prominence in the insurance world due to its wide variety of options, which cater to students, digital nomads, expats and, of course, travelers in general.

One of the differentials of Safety Wing is the focus on insurance plans covering adventure sports and radical activities. (Like World Nomads!)

In addition, their website is nice and allows you to get a quote in a simple and fast way.

Safety Wing travel insurance and coverage for COVID-19

In general, medical expenses related to COVID-19 will be covered by the Safety Wing policy. However, it is always recommended to check the details of the policy before making the purchase to ensure that the coverage is up to date.

International sites to compare and buy travel insurance from different carriers

8. The best place to find and compare cheap travel insurance:

VisitorsCoverage

Unlike the other options mentioned in this list, VisitorsCoverage is not an insurer itself. Instead, it is a platform that allows the viewing and comparison of travel insurance plans from several different companies at the same time.

It is a bit like Momondo, which allows you to compare airline tickets from different companies. Or Rentalcar.com, which does the same car rental.

That is, it is much easier to view all your travel insurance plans options. And finally, compare, choose and buy the best option for your trip.

At VisitorsCoverage, you will find a wide variety of options, including travel insurance plans for business and students.

With a decade of experience in the market, the site serves citizens from more than 175 countries. In addition, according to the available analytics, they offer reliable customer service, available online 7 days a week.

VisitorsCoverage travel insurance and COVID-19 coverage

On the VisitorsCoverage platform, you can check the specific information about the Covid-19 coverage of each insurance plan you are researching. However, it is important to note that, as with most of the companies mentioned earlier, the vast majority of travel insurance plans currently include some type of Covid-19-related protection.

9. Another great site for research and compare cheap travel insurance:

TravelInsurance.com

Like VisitorsCoverage, TravelInsurance.com is a travel insurance portal that allows viewing and comparison of multiple insurance plans offered by multiple companies simultaneously.

To conduct the research, simply enter your personal information and some details about your trip. The platform will then provide a comparative analysis of the available plans, which you can filter according to the rating and price.

An interesting feature of TravelInsurance.com is that in addition to travel insurance, they also offer insurance plans for immigrants, international students and expats.

TravelInsurance.com travel insurance and coverage for COVID-19

When using TravelInsurance.com for your research, you can check the position of each partner insurer in relation to Covid-19 coverage. However, as I mentioned earlier, it is important to note that most of the travel insurance plans available currently include some kind of Covid-19-related protection. Therefore, when exploring the options on the platform, you are likely to find several plans that offer this coverage.

2 bonus options to find and compare different travel insurance plans at once:

AARDY

AARDY is a remarkable travel insurance aggregator platform, which allows you to simultaneously view several options of plans offered by several companies, being described as the “Amazon” of travel insurance.

One feature that stands out at AARDY is its excellent customer service, which is reflected in its high score on TrustPilot.

In addition to the user-friendly search portal, which provides a quick and simple comparison of plans, they also provide various means of contact, such as email, support and live chat, so you can clarify all your doubts and concerns before purchasing your insurance policy.

A relevant information is that AARDY practices social responsibility by donating 10% of its annual revenue to the Special Operations Warrior Foundation, which provides financial assistance to the children of the military members who are deceased in combat. This demonstrates the company’s commitment to humanitarian causes.

AARDY travel insurance and coverage for COVID-19

As AARDY is not a travel insurance provider itself, but rather a portal that allows you to compare insurance from several companies, it is necessary to consult directly the individual insurer to get detailed information about the plans and the coverage offered before buying your plan to see what their position is in the coverage of Covid-19.

InsureMy Trip

Similar to the other “portals” or “aggregators” of travel insurance mentioned above, InsureMyTrip offers an easy and quick way to compare travel insurance plans from multiple companies in one place.

It is very similar to the Momondo, which is an aggregator of air tickets, or Rentalcar.com, which is a car rental aggregator.

One feature that makes InsureMyTrip different is your commitment to quality. If a plan or insurer receives less than 4 stars, it will be removed from the site.

InsureMyTrip has a unique focus on travel insurance. Unlike some other options mentioned above, this platform does not offer insurance plans for expats, immigrants or international students. Its goal is to provide a wide variety of travel insurance plans to meet the needs of travelers on their journeys around the world.

But if you are looking for a plan like this to supplement your travel insurance, I can find out my article on the 5 best and best health insurance for international students or 5 best international health insurance for expatriates and immigrants.

InsureMyTrip Travel Insurance and COVID-19 Coverage

Since InsureMyTrip itself is not a travel insurance provider and is just an aggregator that allows you to compare insurance from multiple companies, you will have to search the individual insurer before buying your plan to see what their position is in Covid-19 coverage.

But wait… Maybe you don’t have to pay for travel insurance!

Here are two sneaky ways to get “free” travel insurance

1. Buy your ticket back with a credit card to (maybe) earn travel insurance.

Based on the type of credit card you have, it is possible that when you buy the round-trip flight with that card, you get a free basic travel insurance plan included in the purchase.

Some of the major card cards, such as Visa, Mastercard, American Express and Diners, offer cards with this benefit. However, it is necessary to contact the card provider or check the website to confirm that your card includes this benefit and how it works.

If you are planning to travel to Europe in the future, it is important to keep this in mind. The free basic travel insurance plan provided by the card may be sufficient to meet the mandatory Schengen insurance requirement.

However, it is critical to understand that the plan offered by the card will be more international health insurance than full travel insurance. This means that it will likely only cover emergency medical care and will not offer coverage for most sports or activities considered “risky.”

In addition, unlike traditional travel insurance, the card plan will not provide coverage or compensation for travel delays, loss of baggage, cancelled flights or other travel-related problems. Therefore, it is important to assess your needs and consider purchasing additional travel insurance if you want more comprehensive protection during your trip.

Also remember that this will not work if you are using miles to buy your ticket. And that the maximum insurance period of these types of credit cards is only 31 days. Therefore, if you are still traveling, you will have to buy a regular travel insurance policy to keep covered.

According to a reader of the blog called Alex, if you have a Visa Platinum credit card and use the accumulated miles with that card to pay the tickets (including taxes and fees) and then make the purchase with the same card, you will be entitled to the worldwide travel insurance offered by the card.

However, it is advisable to confirm this information directly with your credit card operator, as the benefits of credit cards may vary depending on the countries where they are issued. Thank you to Alex for sharing this information!

In addition, thanks to the comment of the reader Ana Luisa, it was revealed that Visa Platinum insurance usually has a validity of 60 days, instead of the 30 days offered by most other credit cards. However, if your trip exceeds this period, it is important to complement the rest of your trip by purchasing a traditional travel insurance policy. For at least the first 2 months, you can save some money by relying on insurance provided by the Visa Platinum card.

2. 2. Use your country of residence health insurance.

Before we conclude, I have one last suggestion for you to consider. Consult your health care provider in your home country to check if they provide any options for international travel insurance.

Often, if you already have a health plan with them, it is possible to purchase travel coverage abroad at a reduced cost (or even without additional cost!). However, it is important to carefully analyze whether the insurance offered covers the destinations you are planning to travel to and all the activities you intend to undertake during the trip. This way, you can ensure that you will be adequately protected during your journey.

3. Take the free CDAM (PI4 and BI2) to have free access to the health system in Portugal, Italy, or Cape Verde

The Certificate of Right to Medical Assistance (CDAM) is a document issued by the Brazilian Ministry of Health that allows free or reduced access to the public health system of some countries abroad.

CDAM PI4 is valid for Portugal and Cape Verde, while CDAM BI2 is used to obtain health care benefits in Italy. These certificates simplify access to health services in hospitals and public health centers in the mentioned countries, allowing Brazilians to be served without costs or with reduced expenses during their stay abroad.

To learn how to take CDAM and the necessary documents, take a look at this page of the Ministry of Health here.

A quick note about cruise travel insurance:

Recently, someone contacted whether any of the mentioned travel insurance plans could be used for cruise travel, which led me to conduct some research.

Based on the information I found, both WorldNomads and WorldTrips offer coverage for cruise travel.

WorldTrips has confirmed by email that its Atlas plan will cover even the ship’s medical evacuation if necessary, depending on the situation.

It appears that all travel insurance plans from WorldNomads cover cruise travel. However, it is important to remember that WorldNomads has an age limit of 66 years, while WorldTrips has no age limit!

I am still awaiting confirmation from the other companies about coverage for cruise travel.

Fraud alert! As mentioned earlier, both WorldNomads and WorldTrips offer the option to purchase their insurance AFTER the start of the trip. However, it is important to take care to avoid possible fraud.

It is essential to understand that this option does NOT allow you to travel without insurance and buy a policy only after you get sick or have an accident to get retroactive coverage.

Insurers are aware of this possibility, so most of them include a “anti-fraud” clause in their policies. This clause stipulates that coverage will only be valid 48 hours after the purchase of the policy.

In other words, if you become seriously ill during the trip and want to purchase insurance immediately to cover treatment, you will need to wait 48 hours before you can seek medical assistance for the coverage to apply. In addition, you will need to prove to the insurance provider that the disease occurred AFTER the acquisition of the policy.

In case of accidents, it is possible to use insurance within this period of 48 hours. However, it will be necessary to prove that the accident occurred AFTER acquiring the plan.

In summary, it is not possible to use insurance to cover a condition or accident that occurred prior to the purchase of the policy. Insurers have procedures for verifying and preventing fraud, and, if there is any irregularity, they will certainly investigate the situation to ensure the integrity of the insurance system.

Can I use travel insurance while living abroad as an expatriate or immigrant?

If you are living abroad or traveling in a country for a short period, it may be good only with travel insurance.

If you are looking for more comprehensive coverage, especially for extended stays abroad, or require proof of health insurance for immigration purposes, it is highly recommended to purchase a specific international health insurance plan for expats or immigrants.

This type of plan is especially developed to meet the health needs of people who reside in another country for a long time. It offers more complete coverage, including not only emergency medical care, but also regular medical appointments, ongoing treatments, routine checkups and other medical needs during your stay abroad.

With international health insurance for expatriates or immigrants, you will have peace of mind and security, knowing that you will have access to adequate and comprehensive medical care throughout your stay outside the country of origin. This type of plan is of utmost importance to ensure that you are properly protected and also to meet the immigration requirements of the country where you intend to establish your residence.

If you want to know more about the differences between travel insurance and international health insurance, see our article on the 3 best international health insurance for expatriates and immigrants.

Or, you can directly check the price with some of the insurers for expatriates and immigrants here:

Now Health International

Can I use my travel insurance during my exchange or while studying abroad?

In short, the answer may vary depending on the specific situation. My suggestion is to start by checking with your school or university for clear information about health insurance requirements.

Generally speaking, if your course or study program lasts less than 3 months and you will only travel on a tourist visa, a standard travel insurance may be suitable.

However, if you need a student visa, you will need to purchase a specific health insurance plan for international students or exchange programs.

This is particularly important if you are going to the United States on a J1, J2 or F1 visa, or if you are traveling to Europe on a Schengen student visa. These types of visas usually require specific health insurance with adequate coverage to ensure that you are protected during your stay abroad. Therefore, it is essential to check and obtain the appropriate insurance plan according to the type of visa and the destination country.

If you are an international student and think you may need one of these special medical insurance plans, take a look at my page with The 3 best and cheapest health insurance for international students and exchanges to learn more.

Once again, you can directly check the price with some of the insurance companies for international students here:

Cigna for International Students

Now Health International

Travel insurance and its coverage for terrorism

I received some comments both in the article in English and in Portuguese asking if travel insurance covers acts of terrorism.

After conducting research, here are the results:

While WorldTrip’s basic travel insurance plan does not include coverage for acts of terrorism, the Atlas Premium plan covers “treatment of injuries and illnesses related to an act of terrorism, to the extent set out in the benefits table and limits.” This means that if you are traveling and unfortunately get involved in a terrorist event, you will be covered if you have the WorldTrip’s Atlas Premium plan.

In addition, it is important to mention that most of the WorldTrip’s plans offer a “Crisis Response Coverage” that protects travelers in situations of civil unrest, political events, natural disasters, and other crises during travel. This coverage includes even “expressed” situations, providing financial support for response, redemption and delivery expenses of personal belongings.

However, it is essential to note that some countries are not covered by the “Creses Response” feature. This includes countries such as Iraq, Afghanistan, Pakistan, Nigeria, Somalia, Venezuela, Iran, Cuba, Sudan and North Korea. Still, it is important to point out that, in most of these countries, regular travel insurance is still valid, except for the part referring to the “crisis” of the coverage, which will not be applied in these specific regions.

General tips to help in requesting reimbursement of travel insurance:

All previously mentioned travel insurance companies have a wide network of hospitals, clinics and doctors. The ideal is to seek treatment from one of the providers of this network to facilitate the payment process, preventing you from needing to disburse money directly, because the treatment account will be sent directly to the insurer (unless the cost exceeds the maximum limit of the coverage).

If an unforeseen event, such as illness or accident, it is recommended to contact the insurer of your travel insurance as soon as possible, so that they can indicate which doctor or hospital in the network you should seek to receive treatment.

If, for some reason, you are unable to reach a network provider, you will need to pay for the treatment out of pocket and subsequently request reimbursement from the insurance company.

However, it is important to be aware that insurers can be strict when granting payments and require all the correct documentation to process reimbursement of medical expenses incurred during the trip.

To facilitate the refund process, here is a list of the documents usually requested by travel insurers when you make a claim to receive reimbursement of medical expenses during the trip.

But first, some terms of insurance to understand:

making a claim: asking an insurer for reimbursement of medical expenses

Insurance company: the travel insurance company

“beneficiary” complainant – the insured person (you) who is requesting money/refund from the insurer

List of documents normally required by travel insurance policies when you request reimbursement of medical expenses (if you have been treated by an out-of-network provider):

- Copy of the national identity of the complainant (driver’s license or other identity issued by the state);

- Copy of the proof of residence (any current proof – from the last 3 months – with the name of the applicant). If you do not have, send a completed residence declaration, signed and with a recognized name by the insurance company;

- For minors, a declaration of residence must be completed, signed and recognized by the respective legal guardian (form provided by the insurer);

- Copy of proof of the complainant;

- Original registration information form, signed by the beneficiary (form provided by the insurer);

- Copy of the passport (identity page + page with stamps of entry and departure from the country where the accident occurred) or other documentation showing that the beneficiary was away from the usual domicile when the accident occurred (also known as your country of origin) – for example: air tickets (in fact, you must always keep your boarding pass until the end of the trip, not only for a possible claim but also to request your miles!);

- Presentation of the original medical report with a description of the procedures, provided by the health professional or medical centre with a clear indication of the diagnosis, clinical history and admission form, in the case of hospitalization;

- Original recipe (if the pharmacy still has the prescription, send your x-ray or document proving that you have taken the medicine in exchange for the prescription);

- Invoicing of medical procedures or receipt of the pharmacy with the prescribed medicines, corresponding to the quality and quantity of the prescription provided;

- Medical care report (explaining the reason, what happened and how was the treatment – both from the travel insurance team and from the health care staff), written by the beneficiary;

- a list of completed expenditure (form provided by the insurer);

- Your contact phone number, address and email;

- Proof of bank information (copy of the header of the bank statement, check or debit card).

And the most challenging thing is that in most cases it may be necessary to send all these physical documents by mail!

Yes, I understand, it’s a big inconvenience. Therefore, it is actually much easier and more agile if you can seek treatment with a doctor who is inside your insurance company’s network. This way, you can avoid all the lost time and the headaches associated with the preparation and sending of this paperwork.

However, if you don’t have any other alternative and need to go through this refund process, don’t worry.

With a little organization and ensuring that all of these documents are in order, your chances of successfully registering your complaint and getting the refund quickly are quite solid!

If you’ve needed to make a complaint before, share your experience and tips in the comments section below to help other readers. This can be valuable for those facing similar situations and seeking guidance during the travel insurance reimbursement process.

To sum up, these are the best travel insurance companies for Peru::

- Insurance Promo

- Real Travel Insurance

- IMG Global

- World Nomads Travel Insurance

- WorldTrips

- Allianz Assistance / Mondial Travel

- Safety Wing

- VisitorsCoverage

- TravelInsurance.com

- AARDY

- InsureMy Trip

My final advice: Important, be sure to purchase travel insurance before your trip! Or if you have forgotten and are already traveling, buy as soon as possible! Or if you have already purchased a policy and need to extend your coverage (which both WorldNomads and WorldTrips allow), make sure you do this before your policy expires!

In this way, you will have the peace of mind that you are covered throughout your journey to Peru.

Now it’s your turn. What has been your experience with travel insurance? Have you had to activate your policy? Which company did you use and how was the refund process? Or have you still had any questions about insurance travel in general?

Share in the comments area below, and I will reply to you!

I wish happy travel! (And I hope you never need to use the travel insurance plan you just purchased!)

Are you planning your next trip?

Don’t forget to purchase travel insurance! You don’t want to stay at your hand if you get sick and or suffer an accident during your vacation. Our page with the 7 Best and Cheapest Travel Insurance on the Market can help you in choosing the best insurance for you besides having discount coupons for the largest insurers!

Have you booked your hotel or hostel? If not, our article with The 6 Best and Cheapest Websites to Find Your Travel Accommodation can help you in this process. There you will also find promotions and discount codes.

You haven’t bought your airfare and want to save money? Take a look at our page with 17 How to Save on the Airfare Tips where you also find the 4 best sites to buy your flights

And finally, will you need to rent a car for your trip? So for sure our page with The 5 Best and Cheapest Sites to Compare and Rent Car Around the World will help you in choosing and save money.

Sign up for our newsletter and stay up to date with exclusive news

that can transform your routine!

Warning: Undefined array key "title" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 12

Warning: Undefined array key "title_tag" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 13