Mastering the Art of Identifying and Valuing Key Assets: A Comprehensive Guide to Unlocking Their True Potential

In today’s fast-paced and ever-evolving world, understanding how to identify and properly value key assets is a game-changer. Whether you’re an entrepreneur looking to make smart investments or someone looking to optimize their personal finances, knowing the ins and outs of valuable assets can lead to tremendous growth, both professionally and personally.

So, what are these assets? How do you identify them? And most importantly, how can you properly value each one to maximize your success?

Let me walk you through the essentials.

What Are Key Assets?

At their core, assets are resources with value. They can take many forms: tangible or intangible, physical or intellectual, long-term or short-term. Assets are anything that can contribute to your wealth, success, or productivity, whether through appreciation, revenue generation, or facilitating your objectives.

Broadly speaking, assets can be classified into two categories:

- Tangible Assets: These are physical items that hold value. Examples include real estate, machinery, inventory, and even precious metals.

- Intangible Assets: These are non-physical items but just as valuable. Think intellectual property, brand reputation, digital assets, and relationships.

Identifying and understanding these assets is the first step to ensuring you’re leveraging them to their full potential.

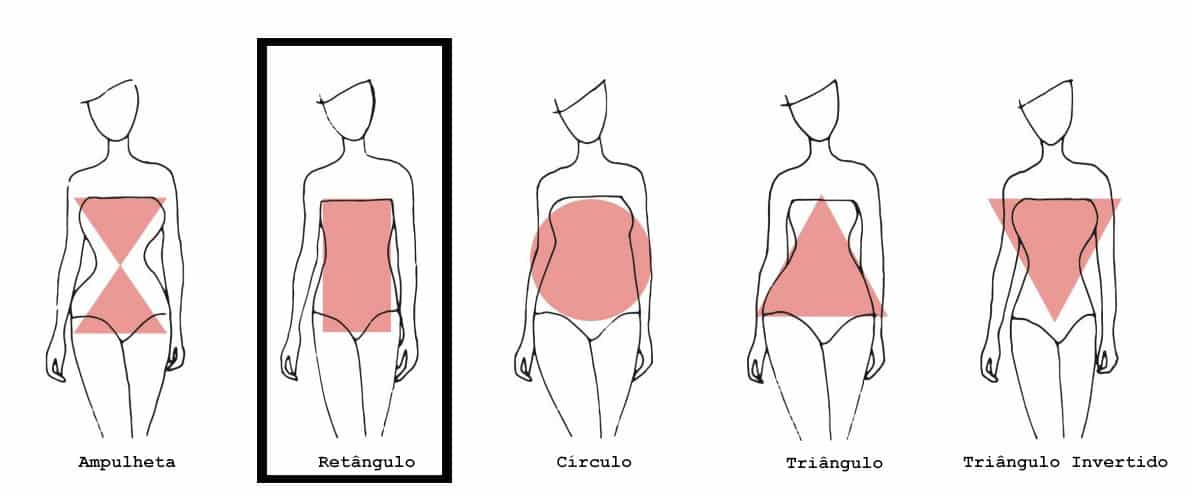

1. Rectangle

How to Identify Key Assets

Identifying the right assets is like setting the foundation for a successful venture. Without the proper understanding of what assets you possess, it’s easy to make hasty decisions or overlook resources that can make a world of difference.

1. Evaluate Your Financial Portfolio

A solid financial portfolio is a great starting point for identifying tangible assets. This could include:

- Real Estate: Owning land or property is one of the most tried-and-true forms of investment. Whether you own a house, commercial property, or undeveloped land, real estate is often an appreciating asset.

- Investments: Stocks, bonds, and other investment vehicles are assets that can grow over time. Take stock of your financial holdings and be aware of their potential value.

- Vehicles and Equipment: These physical assets can be valuable if maintained properly, but keep in mind that they might depreciate over time, unless they are rare or collectible.

2. Recognize Your Intellectual Property (IP)

Intellectual property is often overlooked, but it can be one of the most valuable assets you own. Your business’s proprietary processes, designs, trademarks, patents, and copyrights are intangible assets that have monetary value. These assets may not show up as tangible items on your balance sheet, but they can contribute significantly to your revenue.

3. Assess Your Brand and Reputation

Your reputation is a crucial intangible asset that can drive customer loyalty, attract partnerships, and elevate your business. Building a strong brand identity and maintaining a positive reputation can create long-term value.

If you’re an entrepreneur or business owner, it’s important to know how to measure the value of your brand. Metrics like brand awareness, customer sentiment, and engagement are valuable indicators of the strength of your brand.

4. Relationships and Networks

Another often underestimated asset is your network of professional relationships. These connections can be invaluable, providing opportunities for growth, collaborations, and new business ventures. A strong network can lead to partnerships, introductions to potential investors, and even job opportunities.

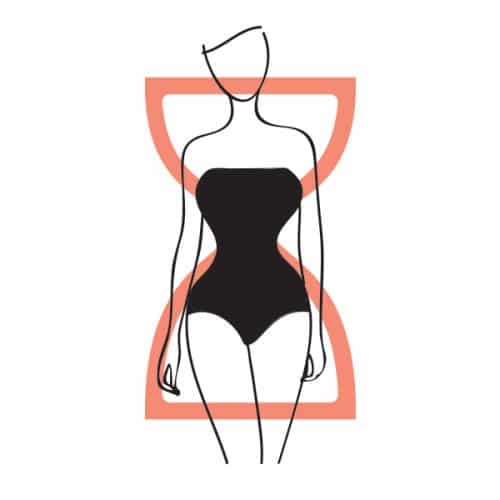

2. Body Shape: Hourglass

Valuing Each Asset

Once you’ve identified your key assets, the next challenge is to value them. Valuing assets isn’t always a straightforward process, especially when it comes to intangible assets. The methods for valuation vary, depending on the type of asset you’re assessing.

1. Tangible Asset Valuation

For tangible assets like real estate, vehicles, and machinery, valuation is relatively simple and involves:

- Market Comparison: Compare similar assets in the market to gauge the potential value of your asset.

- Depreciation: Keep in mind the depreciation rate, especially for assets like vehicles or machinery, which lose value over time.

- Replacement Cost: The cost to replace an asset can be a good indication of its value. For example, the replacement cost of a building or piece of machinery can help assess its worth.

2. Intangible Asset Valuation

Intangible assets like intellectual property, brand reputation, and goodwill require more nuanced approaches. These can be valued through methods like:

- Income Approach: This method involves estimating the future income that the asset is expected to generate. For example, intellectual property like patents can be valued based on the potential licensing revenue they can bring in.

- Market Approach: The market approach compares the intangible asset with similar assets that have been bought or sold in the market. This is especially useful when valuing brands or trademarks.

- Cost Approach: This method focuses on the cost it would take to recreate or replace the asset. This is particularly useful when valuing things like digital assets, like software or proprietary technology.

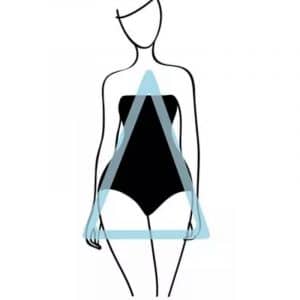

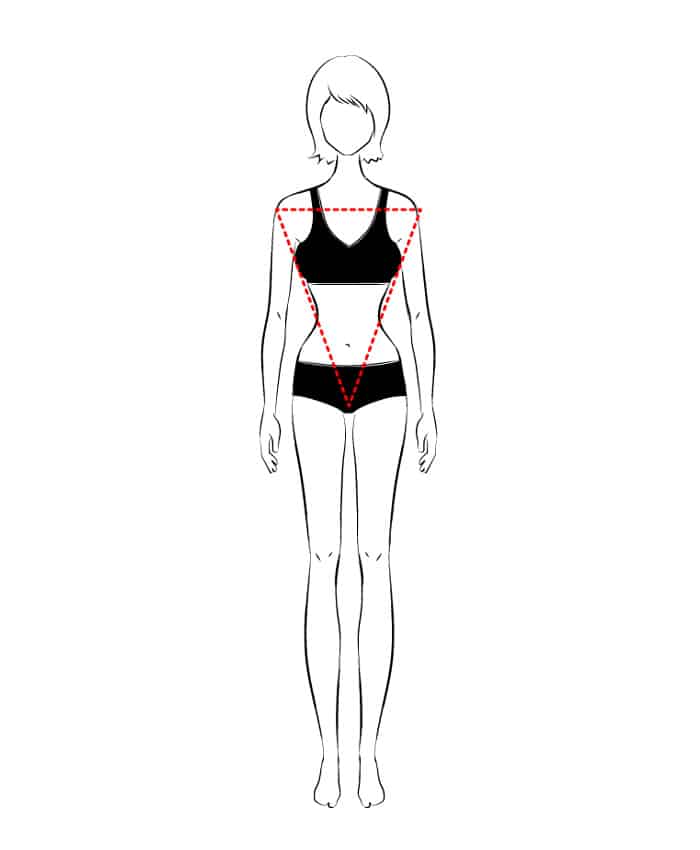

3. Triangle

Why Identifying and Valuing Assets Matters

Understanding your key assets isn’t just about knowing what you have. It’s about being strategic. Properly identifying and valuing these assets can make all the difference in how you manage them to create wealth and success. Here’s why:

- Strategic Investments: By identifying key assets, you can make smarter decisions about where to invest. If you know which assets are most valuable, you can allocate resources more effectively and avoid costly mistakes.

- Financial Health: Valuing your assets helps you understand your true financial worth. This can be vital for assessing your financial health, applying for loans, or seeking investors.

- Risk Management: Having a clear understanding of your assets allows you to manage risks better. For example, knowing the depreciating value of a particular asset helps you plan for replacements or upgrades.

- Growth Opportunities: By recognizing undervalued assets and understanding their potential, you can uncover opportunities for growth and expansion.

4. Inverted triangle

Real-Life Examples of Successful Asset Identification and Valuation

Let’s look at a few real-world examples where asset identification and valuation led to major success stories.

1. Apple’s Brand and Intellectual Property

Apple Inc. has one of the most powerful brands in the world, which has significantly contributed to its valuation. However, Apple’s real strength lies in its intellectual property. Their patents, software, and hardware designs hold immense value, and they strategically leverage these assets to stay ahead of the competition.

2. Real Estate Investment: The Success of Property Developers

Many successful property developers build their fortunes by acquiring and properly valuing real estate. The key to success in this sector is identifying undervalued properties with potential for appreciation. Through strategic renovations or redevelopment, these developers often add significant value to their real estate assets, increasing their worth exponentially.

3. Personal Branding: Influencers and Entrepreneurs

Many influencers and entrepreneurs have built their entire careers around their personal brand. From social media influencers to thought leaders in various industries, personal branding can be a highly valuable intangible asset. By identifying and growing this asset, individuals have managed to build empires, often beyond their primary fields of expertise.

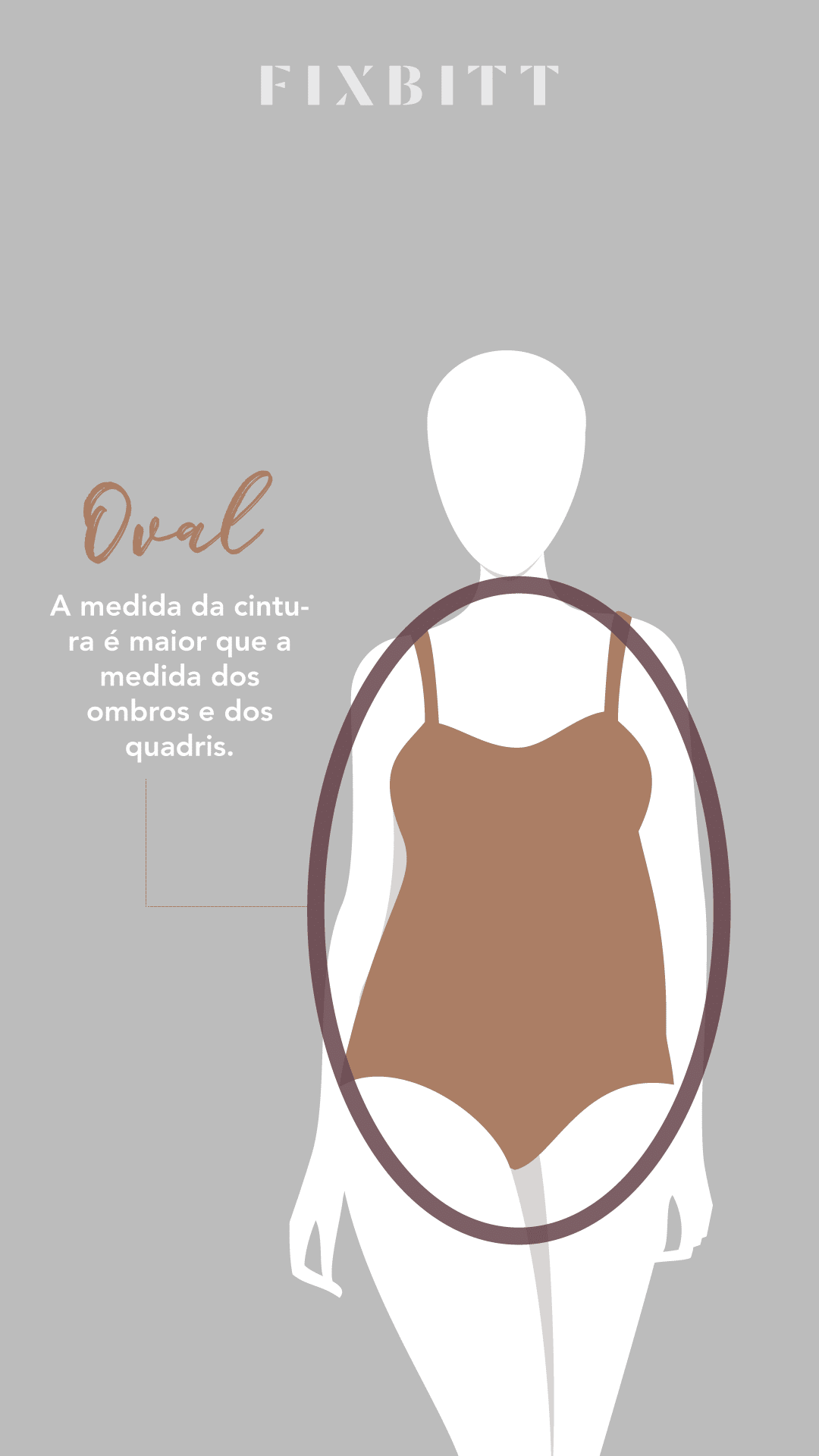

5. Body Shape: Oval

Sign up for our newsletter and stay up to date with exclusive news

that can transform your routine!

Warning: Undefined array key "title" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 12

Warning: Undefined array key "title_tag" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 13