We prepared a complete guide on Green Card Insurance – where to use it, what money it is, which countries it requires to cross the border and much more!

In our post on how to travel by car to Uruguay, one of the biggest doubts we received was about the Green Card Insurance, a matter that is still not clear to our readers. For this reason, we decided to make a super complete post so you know where to throw it, how much it costs to be sure to charge on your trip.

To begin, you need to know that the Green Card is surely mandatory for you to cross by car to the border of two Mercosul countries. Eles são: Argentina, Brazil, Uruguay and Paraguay – isso with your own car or alugado.

And it is independent of the type of trip: it may be for tourism, work or just a short trip, as well as the type of vehicle. Everyone needs to have this insurance, which works like a DPVAT that compensates for physical or material damage that may be caused to other people by vehicles driven by foreigners.

Is it safe that Carta Verde copper?

Or insurance copper All and any damage caused to the vehicle insured to people or objects not transported.

There, it is important not to confuse Carta Verde insurance with travel insurance! Um é only for vehicle and other é for health and people coverage, ok?! Here in this article you can learn more about travel insurance and our recommendations.

If your trip includes Argentina, here we have various dates for Buenos Aires and Mendoza! And even for a longer time, for Chile, it is very important not to travel here! More name-it: no Chile or insurance Carta Verde no oil. In this case, you need to hire SOAPEX insurance – Mandatory Personal Accident Insurance for Foreign Vehicles. It can be purchased on the internet.

To find a place for your car, we recommend the best Rentcars integrator to find your car, whether to drive in Brazil, in South America or anywhere else in the world! Guarantee of excellent service, no small letters and it is still possible to parcel in 12x!

Or you are not even sure Green Card

– Material damages caused to third parties;

– Physical damage such as death, permanent disability and medical-hospital distress caused to third parties;

– Legal costs and payment of attorney's fees for the insured.

And this works like any type of insurance: You pay the costs and the values are only reimbursed by the insurance company within the compensation limits. The maximum period to demand reimbursement, normally, is two years.

O that o insurance Carta Verde NÃO copper

– When the insured vehicle is driven by people: 1) in a state of intoxication or under the influence of any drug that produces deinhibitory, hallucinogenic or sleep-inducing effects; 2) without a valid and compatible qualification card with the respective fare category; 3) that you are in possession of the vehicle in case of theft or theft;

– Lost profits or consequential damages not resulting, directly or indirectly, give responsibility for Material and Corporais Damages covered by the policy;

– When the insured vehicle is under unauthorized ownership;

– If the car is participating in competitions, bets and speed tests;

– Damages caused by insurance: 1) to your ascendants, descendants, spouses and children or any other people who reside with you or depend on you financially; 2) years spent or prepostos of the insurance, when their service, and, in addition, damages caused to partners – leaders of the insurance company;

– When the accident is directly caused by non-observance of legal provisions;

– Damage suffered by people transported, occupying, in the vehicle, places not specifically designated and appropriate for such purpose;

– Damage due to pollution or contamination of the environment caused by the insured vehicle.

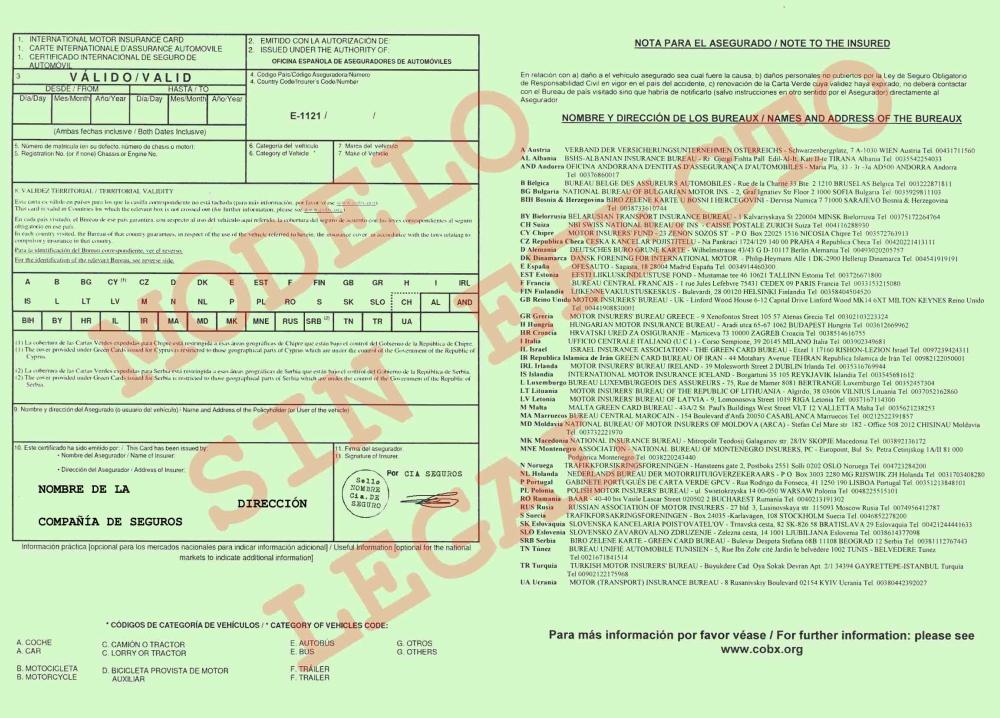

What are the compensation limits?

The minimum limits required (in dollars):

US$ 40,000 per person – corporate damages, medical-hospital expenses and/or permanent disability, and death;

US$ 20,000 for third parties – give us materials;

When there are several claims related to a single event, the limits are:

US$ 200,000 – for corporate damages guarantee

US$ 40,000 – for collateral for material damages

These values do not include values of legal fees and judicial fees. This possuem limit of 50% of the value of the compensation paid to the insured.

Além disso, It is only permitted to contract Green Card insurance per vehicle and its value and duration depend on the interest of the insured, with a maximum period of one year and the possibility of renewal. There is no possibility of increasing compensation by taking out two insurance policies.

How much does Green Card Insurance cost?

The value of Green Card Insurance will vary depending on the duration of its validity, with a minimum duration of 7 days and a value of R$87.80 (December/2022). As the insurance can be valid for 1 year, the prices change very much, so it is worth checking with your insurance company.

Where to do or Insurance

First of all, check your car insurance or then consult your broker, because many insurance companies will have Green Card coverage. Please contact your broker to quote this additional insurance for your trip.

Also, you will also be able to issue the Green Card Insurance at the Consulate of the country you are going to visit, bank agencies that provide this service or any insurance company in the automobile country.

IMPORTANT: If you create your Green Card online, you need to print it on green paper.

For more information about Green Card insurance, access the Federal Government site or leave our comments. This way, other travelers can share experiences and we can update the items to meet all your needs. 🙂

Sign up for our newsletter and stay up to date with exclusive news

that can transform your routine!

Warning: Undefined array key "title" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 12

Warning: Undefined array key "title_tag" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 13