An expedition through South America can provide incredible experiences, but also arouses some anxiety. Among the responsibilities of dealing with airline tickets, making accommodation reservations, planning activities and itineraries, and preparing for jet lag, many explorers neglect one crucial detail: the acquisition of travel insurance.

If you are in this situation, don’t worry! Keep reading to understand the importance of taking out travel insurance for South America, including a list of the most financially advantageous options available!

But before we proceed…

Do I need travel insurance to go to South America?

Arguably, quality travel insurance is absolutely crucial, especially for travelers like me, who engage in activities with high injury potential (and consequently considerable medical expenses!).

Throughout my journeys, I’m an enthusiast of climbing mountains, exploring challenging places, practicing jumping and diving into unusual locations – basically, I accomplish everything I consider to be part of a perfect travel experience!

Imagine snowboarding in Switzerland without the protection of travel insurance, having an accident in the middle of the mountain and needing a helicopter evacuation. The medical bill you would get while you were lying in bed in the hospital would have as many digits as you could leave anyone with heart palpitations just by seeing her!

Investing in travel insurance is a sensible choice, regardless of the destination!

In addition, throughout my adventures, I came across several backpackers who sported the infamous “Thai brand”, which are extensive scars on the legs resulting from burns caused by motorcycle exhausts in Thailand!

After all, who would aim to end up in a public hospital in the heart of Bangkok? With travel insurance, you have the option to be taken care of in a private hospital where you are more likely to receive high-quality care. So it’s yet another compelling reason not to neglect to get insurance before embarking on your next adventure!

But is travel insurance really needed? I don’t practice sports or extreme activities!

Here’s the point: Even if you’re just planning to shop in Miami, it’s extremely important to own travel insurance.

There is always some kind of risk on any trip, including walking down the street and suffering a fall or getting sick.

Relying exclusively on the health system in South America (or in many other countries) without some kind of insurance amounts to exposing yourself to a possible financial disaster.

In addition, several countries, including South America, stipulate the requirement that travelers have some type of health insurance or travel in order to enter the country.

Also remember that travel insurance is not restricted to medical issues. Depending on the plan you choose, it can help cover expenses related to misplacement of baggage, delays on flights, setbacks arising from adverse weather conditions and even the evacuation of the country in situations of civil unrest. Thus, it is a sensible investment to ensure a smooth and safe trip, regardless of the destination or the scheduled activities.

Update on Travel Insurance and the Coronavirus (COVID-19)

It is a fact that the Covid-19 pandemic has not yet been completely eradicated, and it is understandable that people have concerns about the coverage of travel insurance in relation to this disease.

At this time, the vast majority of travel insurance plans offer protection for expenses associated with Covid-19. However, it is strongly recommended that you thoroughly analyze the terms of your policy before acquiring it in order to ensure that you have adequate coverage for possible situations related to this disease.

Insurance terms and conditions may vary, so it is crucial to understand what are the exclusions or limitations regarding Covid-19, if any. By doing this, you will be better prepared and protected in case you face any health problems during your trip.

Keep in mind that the situation of the pandemic can change rapidly, and insurance policies can also be adjusted accordingly. So keep up to date on any changes and be well informed about the conditions of your insurance before embarking on the journey. With proper coverage, you will be able to enjoy your journey with greater tranquility and security.

(OO which for more details, you can also take a look at our article here: International Health and Travel Insurance covers the Coronavirus (COVID-19)?)

How does the health system of South America work?

The health care system in South America can vary significantly from country to country, as each nation has its own health, policy and infrastructure system. Here is some general information on how the health system works in some countries of South America:

- Brazil: I: s

- Brazil has a mixed health system, composed of the Unified Health System (SUS), which offers free health services, and private health services.

- Brazilians can access free medical treatment from the SUS, but many opt for private health plans to get faster care and additional services.

- Argentina: 🙂 and

- Argentina also has a mixed health system, with public and private services.

- Access to health care is free for residents, and the country offers a high standard of medical care.

- Chile: .

- Chile has a mixed health system, with the public sector (Fonasa) and the private sector.

- Fonasa offers free or reduced-price health services to Chilean citizens, while the private sector is accessed through health insurance.

- Colombia: I: I’

- Colombia has a mixed health care system with public and private services.

- The health system is regulated by the government, and residents have access to free or affordable health services.

- Peru: I:

- Peru has a mixed health care system with public and private services.

- Access to health care is free for many procedures, but the private sector is widely used by those seeking more specialized services.

It is important to note that in some countries of South America, especially in rural areas, access to health services may be limited, and the quality of services may vary. Foreign travelers are generally advised to purchase comprehensive travel insurance that covers medical expenses and evacuation in case of emergency. This provides an additional layer of protection, regardless of the country’s specific health system.

Note: The alternatives mentioned above are geared towards travel insurance intended for tourists. However, if you are considering studying in South America, it will be vital to acquire an international health insurance plan for foreign students. On the other hand, if you are moving to South America as a professional or immigrant, a health insurance policy for expats will be fundamental. Some options for these specific circumstances can be found in the next section of this article.

What are the best travel insurance for South America?

If you conduct an internet search on travel insurance, you will find a wide variety of alternatives.

Over the years, however, I have conducted a comprehensive survey of travel insurance companies (and have tried several of them too!). The list below includes the travel insurance options I always end up choosing.

However, it is essential to keep in mind that your final choices will depend on your location and the level and type of coverage you want for your trip.

I recommend taking some time to get a budget from each of these companies for your trip. I understand it may take some time, but the money you can save in the end will be worth it!

The following are the comparative travel insurance sites that allow comparison and purchase of different plans.

1. The largest and cheapest travel insurance portal in Brazil to compare and guarantee the best price:

Promo Insurance (cupom 5% discount OUTCOMF5)

Seguros Promo operates as an aggregator platform that provides and markets travel insurance over the internet, not being an insurer in itself. Through their tool on the website, travelers have the opportunity to compare coverage and prices of different companies and choose the travel insurance that best meets their needs. In addition, Promo Insurance offers assistance in case of claims, facilitating the contact of the customer with the insurer.

It is recommended that, in addition to exploring information about WorldNomads, mentioned above, the user also visits the Promo Insurance website to find other business options and travel insurance plans especially aimed at Brazilians.

In Promo Insurance, you can find several travel insurance alternatives at highly competitive prices. Some of the most affordable travel insurance to South America have been identified in Insurance Promo.

However, it is crucial to be aware of the value of the coverage offered by these insurance. For example, the health care system in the U.S. has high costs, so a coverage of $30,000 would be considered insufficient for travel to that country. On the other hand, the minimum coverage required for the Schengen area in Europe is 30,000 Euros, which currently corresponds to about US$ 33,000. Therefore, the choice of proper coverage will depend on the destination of the trip.

In the case of playing sports or adventure activities during the trip, it is essential to verify that the contracted insurance offers appropriate coverage for these activities, in addition to evaluating the total amount of coverage provided.

A relevant detail is that Insurance Promo also provides travel insurance with global coverage. If the traveler plans to visit more than one continent during his journey, he can acquire a single comprehensive insurance by selecting “international” as a destination. For example, when traveling to Asia and Europe, it is possible to obtain insurance that covers both continents, provided that the coverage is more than 30,000 euros or US$50,000 (minimum amount required for the Schengen Area). In this way, the traveler will be protected for both continents. The same applies to three or more continents.

In addition, it is advisable to check if travel insurance includes coverage for dental treatment, since some plans offer this coverage while others do not.

With regard to payment options, Promo Insurance offers the choice of installments up to 12 times on the credit card without an interest increase or grants 5% discount for purchases with payment via boleto or PIX.

And, to add, there is also a 5% discount code available for use in Promo Insurance: OUTCOMF5.

Therefore, conduct a search in Promo Insurance to check the available options and, if you find more advantageous prices, hire directly with them!

Here are some of the insurance offered by Promo Insurance:

Promo Insurance Travel Insurance and COVID-19 coverage

Seguros Promo operates as an insurance comparison platform and therefore does not directly provide coverage in cases of incidents. Among the insurers available on the platform, only Assist Card, Travel Ace and Intermac offer emergency assistance in situations of suspected Coronavirus. Other companies provide coverage only until the time the disease is diagnosed. It is essential to thoroughly examine the details of each plan’s coverage before choosing the one best suited to your needs during the trip.

Meet the Brazilian Travel Insurance that Cobre COVID-19 here.

2. 2. The other Brazilian travel insurance portal option with great prices:

Real Travel Insurance (link with 17% discount on Real Seguro17)

Another Brazilian platform specialized in the commercialization of travel insurance, similar to Promo Insurance, is Real Travel Insurance. Like Promo Insurance, they are not an insurer in and act as intermediaries in the sale of travel insurance from other companies.

In addition to offering a wide variety of travel insurance, Real Seguro Viagem stands out for its highly competitive prices! On some occasions, I came across travel insurance at Real Seguro Viagem that were identical to those offered by Promo Insurance, but with more affordable values. Or, still, I found the same travel insurance offered by Promo Insurance at the same price, but with a more comprehensive coverage in Real Travel Insurance. Therefore, I consider that it is worth taking a few minutes to request a quote in Real Seguro Viagem and check if you do not find a more advantageous option there.

Note: The tips on the value of coverage, sports, dentist and payment in Real Seguros are similar to Promo Insurance.

Travel Insurance Insurance and Coronavirus coverage

Currently, all necessary medical expenses are covered by Real Seguro’s partner insurance companies until the time COVID-19 is diagnosed. However, if the patient receives the diagnosis of the disease, treatment related to COVID-19 will no longer be included in company coverage, since pandemics are usually specified as risks excluded in insurance policies. It is essential to thoroughly examine the coverage of each plan before purchasing travel insurance, especially in relation to specific situations such as pandemics.

3. The option of well-known insurance company and average price:

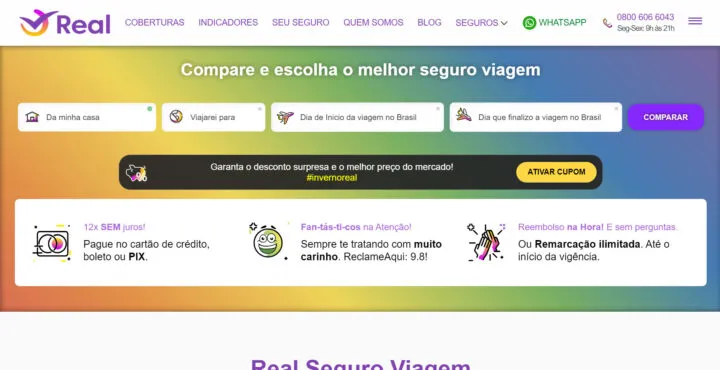

IMG Global (accepted citizens of all countries!)

The International Medical Group (IMG) is a highly reputable insurer from the United States that provides travel insurance for travelers from more than 190 countries.

Therefore, regardless of its origin, IMG stands out as an excellent option to find travel insurance for South America!

They have a travel insurance plan available only to Americans (Patriot Travel Medical Insurance) and another one available to non-U.S. travelers (Patriot America Plus).

You have the freedom to choose the desired level of coverage, with options ranging from $50,000 to $500,000, while deductibles can be adjusted from $0 to $2,500.

The values shown are generally competitive. However, similar to some of the alternatives mentioned above, certain activities are not covered by the policy. Therefore, it is highly recommended to perform a thorough contract reading to confirm that it covers all essential protections before finalizing the purchase.

Travel insurance for seniors (65+): One thing that makes IMG unique is that they offer a tailor-made travel insurance plan for travelers 65 and older, called GlobeHopper Senior.

IMGlobal travel insurance and coverage for COVID-19

4. 4. The best and most comprehensive travel insurance for backpackers and adventurous travellers:

(5% discount coupon: comfort5comfort5)

I consider World Nomads to be the most suitable travel insurer for backpackers.

Whenever I am exploring regions where I plan to participate in more adventurous or considered “risky” activities (such as snowboarding, canyoning, glacier walks, forgoing, diving in deep waters, skiing, climbing, among others), I make sure to acquire a policy with World Nomads.

They cover virtually every activity, and to date, I have not found another company that offers superior coverage for ALL activities included in World Nomads policies. (If you know any other, please share in the comments below!)

If you have a specific activity in mind and want to check if it will be covered by World Nomads, you can check out this page here.

Basically, there are two types of policies available at World Nomads. The first is the “Standard” policy. Even though you have planned some adventure activities, the “Standard” option can still be suitable, as it offers emergency medical coverage for activities such as alpine skiing or hiking up to 6,000 meters (almost 20,000 feet)!

Otherwise, you also have the option of the “Explorer” plan, ideal for more adventurous travelers. This plan will cover almost any other activity imaginable. (However, make sure you review your plan again before buying, if you have something specific in mind that you want to include.)

Another highlight of World Nomads is the option to add optional coverage for “high-value specific items like iPhones and digital cameras.” If you are traveling with many electronic devices or in areas where theft is common (like my home country, Brazil, for example), this can be a smart option.

I would also like to mention that, based on my personal experience when applying for a refund after getting sick in Thailand, the World Nomads customer service team is highly helpful and easy to deal with.

Another relevant point is that with World Nomads, you have the flexibility to purchase your travel insurance even if you have already started the trip. You do not need to be in your country of residence to acquire or extend a policy.

You can get a 5% discount code on your World Nomads travel insurance policy using the coupon code “comfort5.”

(P.S. If you are like me and you are also addicted to sports and adventure activities and wish to have good travel insurance that covers them, here are two other items you might like: 3 Best International Travel Insurance for Extreme Sports and Adventure Activities and 9 tips to stay in shape during your travels.)

WorldNomads travel insurance and COVID-19 coverage

As of the date of this publication, World Nomads has not provided conclusive information on whether its insurance plans include COVID-19 treatment. However, in order to obtain the latest information on the coverage related to the coronavirus, it is advisable to check directly on your website, available here.

5. . 5. One of the cheapest travel insurance companies you will find out there:

WorldTrips (formerly Atlas Travel)

Based on my experience, WorldTrips’ travel insurance plans often stand out as some of the most affordable options available in the market. However, it is crucial to note that due to their affordability in terms of price, these plans may not provide as comprehensive coverage as renowned companies, such as World Nomads.

For this reason, I usually opt for WorldTrips services when traveling to destinations considered safer, especially in cities in the United States or Europe.

Although I have acquired WorldTrips travel insurance plans in the past, fortunately I have never had to trigger the refund process. Therefore, I cannot provide a definitive assessment of how this process works. However, I have found some reports from other travelers who have successfully requested a refund. It looks like WorldTrips is a great choice for budget travelers looking for budget insurance.

In general, WorldTrips serves citizens of various nations, although there are some exceptions. They offer plans of different sizes and types, ranging from backpacking trips around the world over a full year to short study abroad trips for college students.

An interesting feature of WorldTrips is that you can acquire a policy even after you have already started your trip. Therefore, if you are abroad and decide to buy or extend a plan, there are no problems.

Unlike many other insurance companies, WorldTrips sets no age limit! However, it is relevant to mention that the cost of the plan increases based on age. Also, when you are over 70 and then 80 years old, coverage limits can decrease. Therefore, it is natural for older people to pay more than younger people for the same coverage.

It is a rarity to find insurers that offer coverage for seniors, making WorldTrips a solid option for travel insurance in this age group!

WorldTrips Travel Insurance and Coverage for COVID-19

6. . 6. One of Brazil’s Best International Travel Insurance

Allianz Assistance / Mondial Travel

I would also like to emphasize Allianz/Mondial, as many readers have recommended this travel insurance. The Allianz Brasil website for international travel insurance is adapted for Brazilians, providing all information in Portuguese and counting on customer service in Brazil.

If you feel more comfortable using local business English sites, Allianz is an excellent alternative, as well as having highly competitive prices. They also offer annual travel insurance to multiple destinations!

Despite the generally attractive prices, it is imperative to check the “general conditions” to ensure that this insurance meets your needs, since it may not cover all the activities you intend to perform.

In addition, they allow installment up to 6 times on the credit card for purchases over R$ 120.00.

Allianz Travel Insurance and COVID-19 coverage

The insurer does not cover the treatment of COVID-19. Your expenses will only be paid until the time of diagnosis of the disease.

7. 7. The new international travel insurance company for digital nomads and adventure sports and extremes:

Safety Wing

One of the differentials of Safety Wing is the focus on insurance plans covering adventure sports and radical activities. (Like World Nomads!)

In addition, their website is fun and allows you to get a quote easily and quickly.

Safety Wing travel insurance and coverage for COVID-19

International sites to compare and buy travel insurance from different carriers

8. The best place to find and compare cheap travel insurance:

VisitorsCoverage

It is a bit like Momondo, which allows you to compare airline tickets from different companies. Or Rentalcar.com, which does the same car rental.

That is, it is much easier to view all your travel insurance plans options. And finally, compare, choose and buy the best option for your trip.

On the VisitorsCoverage portal, it is feasible to explore a wide variety of options, which cover travel insurance plans for both business and students.

With a decade of experience in the industry, the platform serves individuals from more than 175 nations. Additionally, as indicated by the available reviews, they offer reliable customer service, with online support available during the seven days of the week.

VisitorsCoverage travel insurance and COVID-19 coverage

9. . . . . Another great site for research and compare cheap travel insurance:

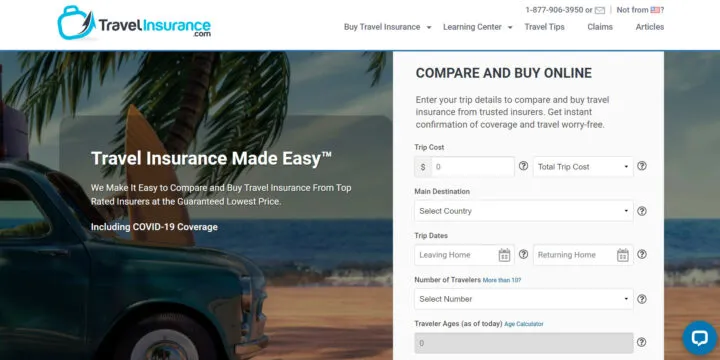

TravelInsurance.com

Similar to VisitorsCoverage, TravelInsurance.com is a travel insurance platform that facilitates viewing and comparing several plans offered by multiple companies simultaneously.

To start your research, simply provide your personal data and some details about your trip. The platform will then present a comparative analysis of the available plans, allowing you to filter according to the rating and price.

An interesting feature of TravelInsurance.com is that in addition to travel insurance, they also offer insurance plans for immigrants, international students and expats.

TravelInsurance.com travel insurance and coverage for COVID-19

2 bonus options to find and compare different travel insurance plans at once:

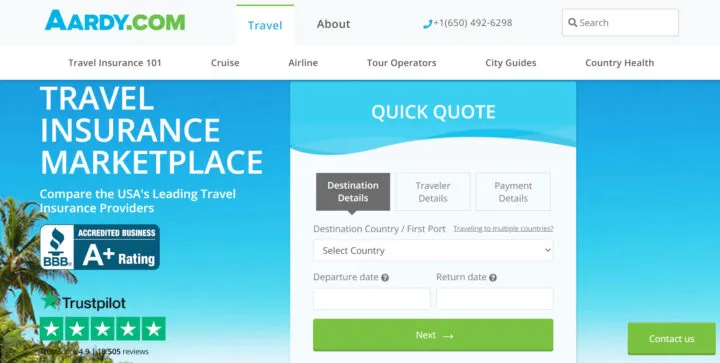

AARDY

AARDY is a prominent travel insurance aggregator platform that offers the simultaneous visualization of several options of plans provided by several companies, being equivalent to the “Amazon” of travel insurance.

A notable feature of AARDY is its high quality customer service, reflected in its excellent rating on TrustPilot.

In addition to the easy-to-use research portal, which allows a quick and uncomplicated comparison of the plans, they also provide several contact options, such as email, support and live chat, to clarify all your doubts and concerns before purchasing your insurance policy.

It is important to note that AARDY practices social responsibility, allocating 10% of its annual revenue to the Special Operations Warrior Foundation, which grants financial assistance to the children of military personnel who are killed in combat. This demonstrates the company’s commitment to humanitarian causes.

AARDY travel insurance and coverage for COVID-19

As AARDY is not a travel insurance provider itself, but rather a portal that allows you to compare insurance from several companies, it is necessary to consult directly the individual insurer to get detailed information about the plans and the coverage offered before buying your plan to see what their position is in the coverage of Covid-19.

InsureMy Trip

It is very similar to the Momondo, which is an aggregator of air tickets, or Rentalcar.com, which is a car rental aggregator.

A distinctive point of InsureMyTrip is your commitment to quality. If a plan or insurer receives a rating of less than 4 stars, it will be removed from the site.

InsureMyTrip is exclusively dedicated to travel insurance. Unlike some other options mentioned above, this platform does not offer insurance plans for expatriates, immigrants or international students. Its focus is on providing a wide variety of travel insurance plans to meet the needs of travelers on their adventures around the world.

But if you are looking for a plan like this to supplement your travel insurance, I can find out my article on the 5 best and best health insurance for international students or 5 best international health insurance for expatriates and immigrants.

InsureMyTrip Travel Insurance and COVID-19 Coverage

Since InsureMyTrip itself is not a travel insurance provider and is just an aggregator that allows you to compare insurance from multiple companies, you will have to search the individual insurer before buying your plan to see what their position is in Covid-19 coverage.

But wait… Maybe you don’t have to pay for travel insurance!

Here are two sneaky ways to get “free” travel insurance

1. Buy your ticket back with a credit card to (maybe) earn travel insurance.

Based on the type of credit card you have, it is possible that when you purchase the round-trip ticket with that card, you receive a basic travel insurance plan at no additional cost included in the purchase.

Some of the major credit card networks, such as Visa, Mastercard, American Express and Diners, offer cards with this benefit. However, it is important to contact the card issuer or check the site to confirm that your card includes this benefit and how it operates.

If you have plans to travel to Europe in the future, it is relevant to keep this in mind. The basic travel insurance plan provided by the card can meet the mandatory requirements of Schengen insurance.

However, it is essential to understand that the plan offered by the card will more resemble international health insurance than complete travel insurance. This implies that it will likely only cover emergency medical treatments and will not include protection for most sports or activities considered “risky.”

In addition, in contrast to traditional travel insurance, the card plan will not offer coverage or compensation for travel delays, misplacement of baggage, cancelled flights or other travel-related problems. Therefore, it is crucial to assess your needs and consider purchasing additional travel insurance if you want more comprehensive protection during your trip.

Also remember that this will not work if you are using miles to buy your ticket. And that the maximum insurance period of these types of credit cards is only 31 days. Therefore, if you are still traveling, you will have to buy a regular travel insurance policy to keep covered.

GREEN: According to a blog reader named Alex, if you have a Visa Platinum credit card and use the accumulated miles with that card to pay for tickets (including taxes and fees) and then make the purchase with the same card, you will be entitled to enjoy the overall travel insurance offered by the card.

However, it is advisable to check directly with your credit card issuers this information, as the benefits of credit cards tend to vary depending on the countries where they are issued. Thank you to Alex for sharing this insight!

In addition, thanks to the comment of the reader Ana Luisa, it was clarified that the Visa Platinum insurance usually has a validity of 60 days, as opposed to the 30 days offered by most other credit cards. However, if your trip extends beyond this period, it is vital to complement the rest of your journey by acquiring a conventional travel insurance policy. For at least the first 2 months, you can save some money by relying on the insurance provided by the Visa Platinum card.

2. 2. Use your country of residence health insurance.

Before we conclude, I recommend that you contact your health insurance provider in your home country to check if they provide any international travel insurance options.

Often, if you already have health insurance with them, it is possible to purchase a travel coverage abroad at a reduced cost (or even for free!). However, it is essential to carry out a thorough check to ensure that the insurance offered covers the destinations planned for your trip and all the activities you want to carry out during the route. This will ensure that you are properly supported throughout your journey.

3. Take the free CDAM (PI4 and BI2) to have free access to the health system in Portugal, Italy, or Cape Verde

The Certificate of Right to Medical Assistance (CDAM) is a document issued by the Brazilian Ministry of Health that guarantees free or reduced access to public health services in certain countries abroad.

CDAM PI4 is valid for Portugal and Cape Verde, while CDAM BI2 is intended to provide medical assistance benefits in Italy. These certificates simplify access to health care in hospitals and public health centers in the countries mentioned, allowing Brazilian citizens to receive medical care for free or at reduced prices during their stay abroad.

To learn how to take CDAM and the necessary documents, take a look at this page of the Ministry of Health here.

A quick note about cruise travel insurance:

Recently, a reader raised a question about the suitability of the travel insurance plans mentioned for cruise voyages, which motivated me to conduct a comprehensive survey.

Based on the information obtained, both WorldNomads and WorldTrips offer coverage for cruise travel.

WorldTrips has confirmed by email communication that its Atlas plan includes coverage for the ship’s medical evacuation when necessary, depending on the circumstances.

It appears that all travel insurance plans from WorldNomads cover cruise travel. However, it is important to note that WorldNomads sets an age limit of 66 years for its coverage, while WorldTrips does not impose such an age limit.

I am still awaiting confirmation from the other companies mentioned about extending their coverage for cruise travel.

Fraud alert! As mentioned above, both WorldNomads and WorldTrips allow you to purchase your insurance AFTER the start of the trip. However, it is essential to highlight that this option does not allow you to travel without insurance and buy a policy only after getting sick or suffering an accident, seeking retroactive coverage.

It is crucial to understand that insurers are aware of this possibility, and so most of them include an “anti-fraud” clause in their policies. This clause provides that the coverage becomes valid 48 hours after the purchase of the policy.

In other words, if you become seriously ill during the trip and wish to purchase insurance immediately to cover the treatment, you will be required to wait 48 hours before seeking medical assistance for the coverage to apply. In addition, it will be necessary to demonstrate to the insurance provider that the disease has occurred AFTER the acquisition of the policy.

In the case of accidents, it is possible to use insurance within this 48-hour period. However, it will be necessary to prove that the accident occurred AFTER the purchase of the plan.

In summary, it is not possible to use insurance to cover a condition or accident that occurred prior to the purchase of the policy. Insurers have procedures to verify and prevent fraud and, if any irregularities are suspected, will certainly investigate the situation to preserve the integrity of the insurance system.

Can I use travel insurance while living abroad as an expatriate or immigrant?

To summarize, the answer may vary depending on the specific situation. I recommend starting by consulting your educational institution for accurate information on health insurance requirements.

Generally speaking, if your course period or study program is less than 3 months and you are traveling on a tourist visa, a traditional travel insurance may be sufficient.

However, if you need a student visa, you will need to purchase a health insurance plan specially aimed at international students or exchange programs.

This is especially relevant if you are going to the United States on a J1, J2 or F1 visa, or if you are planning a trip to Europe on a Schengen student visa. Typically, these types of visas require specific health insurance with adequate coverage to ensure their protection during the period abroad. Therefore, it is extremely important to verify and obtain the appropriate insurance plan, considering the type of visa and the destination country.

If you are an international student and think you may need one of these special medical insurance plans, take a look at my page with The 3 best and cheapest health insurance for international students and exchanges to learn more.

Once again, you can directly check the price with some of the insurance companies for international students here:

IMGlobal

Cigna for International Students

Now Health International

Travel insurance and its coverage for terrorism

I received several questions about whether travel insurance covers acts of terrorism, both in the article in English and Portuguese. After a detailed search, I share the following results:

Although WorldTrips’ basic travel insurance plan does not cover acts of terrorism, the Atlas Premium plan includes coverage for “treatment of injuries and diseases resulting from acts of terrorism, to the extent set out in the benefits table and limits.” Therefore, if you are involved in a terrorist event during your trip and have the WorldTrips Atlas Premium plan, you will be protected by this safeguard.

In addition, most of the plans of WorldTrips offer a “Creses Response Coverage”, which protects travelers in situations of civil unrest, political events, natural disasters and other emergencies during the trip. This coverage even covers events like “light watering,” providing financial assistance for responsiveness, rescue, and recovery expenses.

However, it is important to note that some countries are not included in the benefit of “Creed Response”. Among these countries are Iraq, Afghanistan, Pakistan, Nigeria, Somalia, Venezuela, Iran, Cuba, Sudan, and North Korea. Despite this, the common coverage of travel insurance remains valid in most of these nations, except for the “crise-related” part of the cover, which will not be applied in these specific areas.

Here are some general guidelines to facilitate the process of requesting a refund for travel insurance:

- All previously mentioned travel insurance companies maintain an extensive network of hospitals, clinics and medical partners. It is recommended to seek treatment from one of these service providers to simplify the payment process, avoiding paying directly for the treatment, because the invoice will be sent directly to the insurer (unless the cost exceeds the maximum limit of the coverage).

- In case of unforeseen events, such as illness or accident, it is advisable to contact the insurer of your travel insurance as soon as possible so that they can indicate which doctor or hospital of the network to look for treatment.

- If, for some reason, it is not possible to access a network medical service provider, you will be required to pay for the treatment of your own pocket and then request reimbursement from the insurer.

- However, it is essential to be aware that insurers can be strict in the analysis of payment claims and may require all correct documents to process reimbursement of medical expenses incurred during the trip.

To expedite the refund process, I present below a list of the documents usually required by travel insurers when requesting reimbursement of medical expenses during the trip.

But first, some terms of insurance to understand:

making a claim: asking an insurer for reimbursement of medical expenses

Insurance company: the travel insurance company

“beneficiary” complainant – the insured person (you) who is requesting money/refund from the insurer

List of documents normally required by travel insurance policies when you request reimbursement of medical expenses (if you have been treated by an out-of-network provider):

- Copy of the national identity of the complainant (driver’s license or other identity issued by the state);

- Copy of the proof of residence (any current proof – from the last 3 months – with the name of the applicant). If you do not have, send a completed residence declaration, signed and with a recognized name by the insurance company;

- For minors, a declaration of residence must be completed, signed and recognized by the respective legal guardian (form provided by the insurer);

- Copy of proof of the complainant;

- Original registration information form, signed by the beneficiary (form provided by the insurer);

- Copy of the passport (identity page + page with stamps of entry and departure from the country where the accident occurred) or other documentation showing that the beneficiary was away from the usual domicile when the accident occurred (also known as your country of origin) – for example: air tickets (in fact, you must always keep your boarding pass until the end of the trip, not only for a possible claim but also to request your miles!);

- Presentation of the original medical report with a description of the procedures, provided by the health professional or medical centre with a clear indication of the diagnosis, clinical history and admission form, in the case of hospitalization;

- Original recipe (if the pharmacy still has the prescription, send your x-ray or document proving that you have taken the medicine in exchange for the prescription);

- Invoicing of medical procedures or receipt of the pharmacy with the prescribed medicines, corresponding to the quality and quantity of the prescription provided;

- Medical care report (explaining the reason, what happened and how was the treatment – both from the travel insurance team and from the health care staff), written by the beneficiary;

- a list of completed expenditure (form provided by the insurer);

- Your contact phone number, address and email;

- Proof of bank information (copy of the header of the bank statement, check or debit card).

And what complicates the situation even more is that, in many circumstances, it may be necessary to send all these physical documents through the postal services!

I fully understand that this is a great inconvenience. This is why it becomes much more practical and efficient to seek medical treatment with a professional who is part of your insurance company’s network of providers. This will allow you to avoid all the time lost and the complexities associated with collecting and submitting these papers.

However, if you are forced to go through this refund process, do not worry.

With a little organization and ensuring that all these documents are in order, your chances of succeeding when registering the refund request and receiving compensation in an agile way are quite solid!

If you have had experience in requesting refunds before, share your experiences and tips in the comments section below, aiming to help other readers. This can prove extremely valuable to those facing similar situations and seek guidance during the travel insurance reimbursement claim process.

To sum up, these are the best travel insurance companies for South America:

- Insurance Promo

- Real Travel Insurance

- IMG Global

- World Nomads Travel Insurance

- WorldTrips

- Allianz Assistance / Mondial Travel

- Safety Wing

- VisitorsCoverage

- TravelInsurance.com

- AARDY

- InsureMy Trip

My final advice:

It is essential to purchase travel insurance before starting your journey! If you are already traveling and forgot to make the purchase, do not hesitate to immediately purchase your insurance! In addition, if you already have a policy and need to extend your coverage (option allowed by both WorldNomads and WorldTrips), be sure to carry out this extension before the expiration of your policy!

By following these guidelines, you will ensure the peace of mind of being protected for the duration of your trip to South America.

Now is the time to share your experience with travel insurance. Have you ever had to activate your policy? Which insurance company used and how was the reimbursement process? Or maybe have any questions about travel insurance in general?

Feel free to share your insights in the comments section below, and I am available to answer all your questions!

I wish you journeys full of joy! (And I hope you never really need to use the travel insurance plan you just purchased!)

Sign up for our newsletter and stay up to date with exclusive news

that can transform your routine!

Warning: Undefined array key "title" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 12

Warning: Undefined array key "title_tag" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 13