If you want to be an international student in Mexico, did you know that most schools require you to have health insurance to apply? So what are your best options if you are just taking a short course? Or if you need a policy over a year old? Take a look at the article below to find all the answers!

A Health Insurance is a service that many students do not know they need, but that is very important to ensure a quiet and safe stay abroad. In addition, you will likely need to present a proof of medical coverage to enroll in the course!

With this in mind, I have separated the best insurance options for students in Mexico, along with information on student visas, most common courses and the Mexican health system.

Check it out!

Why should international students in Mexico have health insurance?

The main reason to take out health insurance is to ensure that you are covered if you need medical care in your new country of residence.

All international students studying in Mexico must be covered by public or private health insurance. Many international students are eligible to participate in Mexico’s universal health care coverage, although this depends on factors such as age, country of origin and duration of their degree program.

This is not news to anyone, right? In addition to this reason, there are others that I consider relevant that I will explain below.

The right international student insurance plan for you depends on the time you will study in Mexico, whether you will need a visa (and if so, what insurance requirements you need to meet), whether you will be eligible for the national health system in Mexico, as well as your personal situation and choices.

And all this brings us to the next point…

What student health insurance is required for a student visa in Mexico?

If you are in doubt, know that health insurance is mandatory to study in Mexico.

Expats living in Mexico can apply for health benefits in two ways: Universal Health Insurance and Private Health Insurance.

To learn more about the types of courses you can study in Mexico and the necessary visas, continue reading the article after the list of the best international health insurance for international students in Mexico.

As always, I recommend that you make a quick budget online with all the companies I suggest here. It can take a little time, but you may end up saving good money at the end of the day!

Note: The insurance companies for international students that I mention here are all foreign. However, if you want to deal with Brazilian companies, take a look at Promo Insurance and Real Insurance. I talk about them at the end of the article.

Oh, oh! And there is a table at the end comparing the different student insurance!

The 5 Best and Cheapest Health Insurance for International Students in Mexico

IMGlobal offers a variety of student insurance plans (as well as insurance plans for expatriates in general).

They have three different insurance plans made specifically for students. But as one of them is only for students studying abroad in the United States (The Patriot Exchange Program), let’s just talk about two of them here.

Plan 1: Student Health Advantage

This program must have enough to meet all health coverage requirements of your school (but be sure to first check the minimum coverage required!).

This specific plan covers many things that many others don’t – including mental health-related disorders, maternity care, and pre-existing conditions. IMG also covers COVID-19 costs like any other disease and injury that are subject to the terms and conditions of the policy.

Plan 2: Student Health Advantage Platinum

This plan is the same as the previous one, but offers double the maximum coverage: $1,000,000

What I like about IMG International Student Insurance:

- These plans are designed specifically for students

- They cover students of all nationalities

- They have more than 17,000 health care providers to choose from around the world

- They have 24/7 customer service

- They cover COVID-19 and telemedicine consultations

What I don’t like about IMG International Student Insurance:

- In some of his plans, there is a 1-year waiting period for coverage of pre-existing diseases

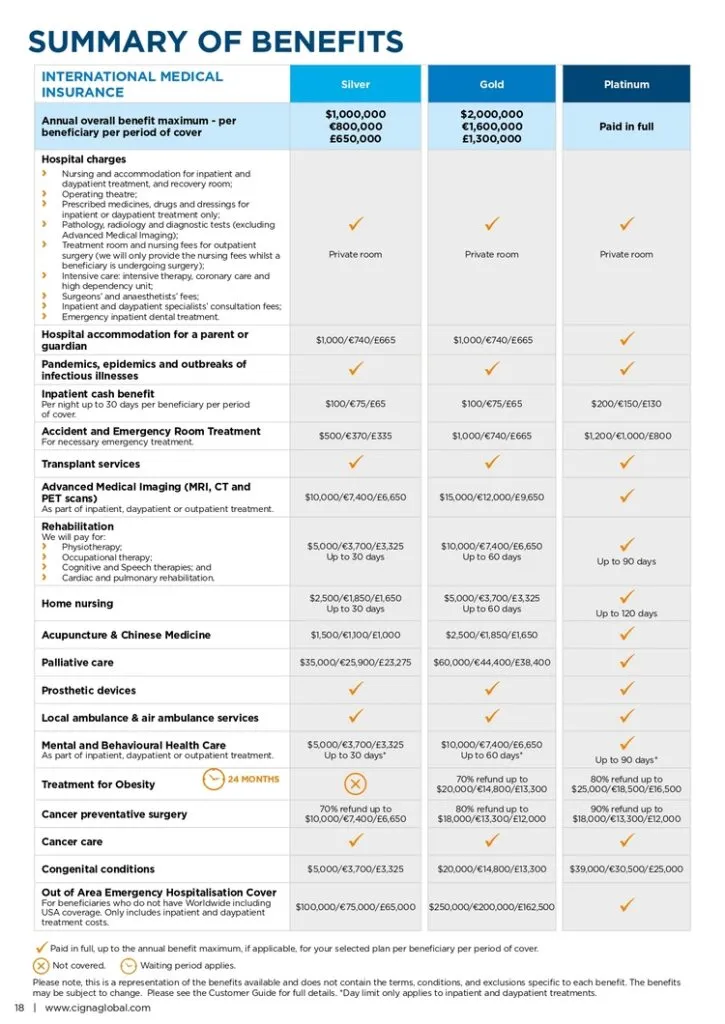

Cigna Global, one of the world’s largest health insurers, offers plans for travelers, expats and (of course!) international students.

They offer 3 main plans: Silver, Gold and Platinum. These plans will cover you not only in Mexico, but around the world! And if you have plans to visit the United States during your stay in Mexico, you can choose to want to be covered there as well (although this makes your policy a little more expensive, then it may be best to get just a short travel insurance for your visit to the US).

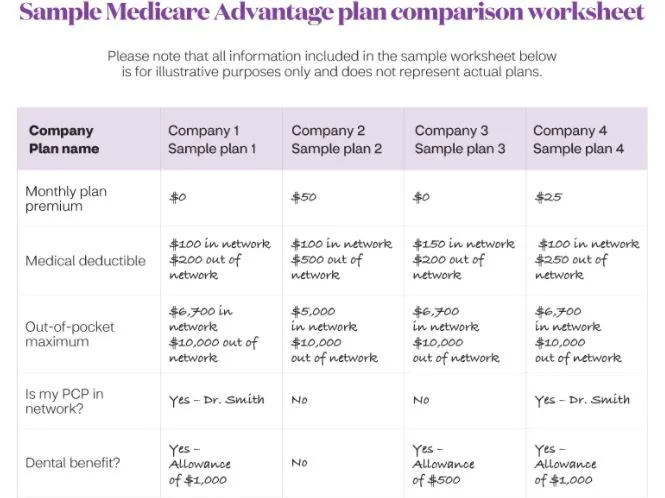

Here is a table comparing your plan options:

Cigna plans are really flexible and allow you to add what you need (including things like dental and ophthalmologic treatments or international evacuation and crisis care).

The company also has a flexible payment policy and offers several options such as annual, monthly and quarterly payments.

What I like about International Health Insurance for Cigna Global Students:

- They respond to complaints quickly (according to the company, 95% of refund requests are received in 10 days)

- The online help center offers access to a list of over 3,000 hospitals, as well as information guides

- They partner with more than 1.65 million hospitals, doctors, clinics, and specialists around the world (offering many options of choice if you need medical care)

- They have assistance 24 hours a day, 7 days a week, to answer any of their questions

What I don’t like about Cigna Global Student International Health Insurance:

- Your most basic plan does not cover prenatal and postnatal care

- They do not include coverage for outpatient consultations with specialists and doctors

Now Health International stands out as a leader in the international insurance market, with its main objective being to provide customers with efficient and affordable plans that guarantee their satisfaction.

In this sense, one of the main advantages offered by this company is the high quality customer service, which stands out for its agility and practicality in the provision of information.

All Now Health plans are carefully designed to meet, guide and solve the challenges faced by foreigners residing in other countries, including international students and exchange students around the world.

In addition, all plans are customizable, allowing them to be perfectly tuned to meet all of your individual needs.

What I like about the insurance for Now Health International student:

- Clear information and 24/7 customer service

- Coverage in more than 190 countries and territories

- Varied international insurance options and customizable plans

- Some plans offer coverage of maternity routines

What I don’t like about the insurance for student Now Health International:

- In some procedures Now Health works with reimbursement system

- For plans with routine maternity coverage it is necessary to wait a grace period of 12 months to access this benefit

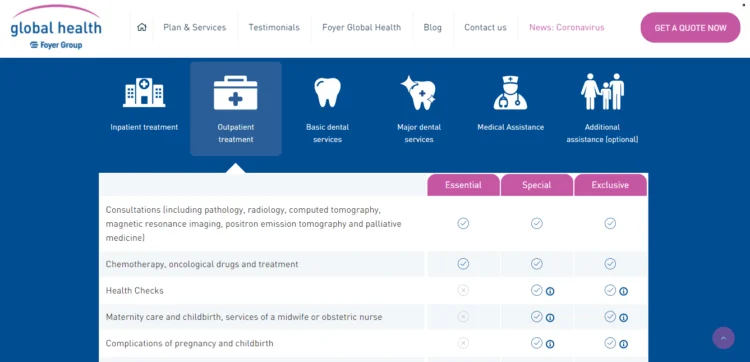

Basic or Premium? Short or long-term stay in Mexico? Alone or with the family? Regardless of what you need, you can find a plan with Foyer Global Health that works for you.

The company has 3 different plans. Here’s a quick rundown of what each of these plans includes:

ESSENTIAL

- Consultations, surgery and anesthetics

- Devices (such as cardiac pacemakers), if necessary, as a rescue measure

- Congenital diseases (up to a maximum of $100,000 per life)

- Does not cover maternity and childbirth

SPECIAL

- Consultations, surgery and anesthetics

- Auxiliaries and therapeutic devices (such as artificial limbs and prostheses) up to $2,000

- Congenital diseases up to a maximum of 150,000 euros per life

- Maternity and childbirth care (up to 5,000 euros with a 10-month waiting period)

EXCLUSIVE

- Consultations, surgery and anesthetics

- Unlimited therapeutic devices

- Congenital diseases up to a maximum of 200,000 euros per life

- Maternity care, birth care and midwidrth or nursing services in the hospital (up to 20,000 euros with a waiting period of 10 months)

What I like about Foyer Global Health plans:

- All plans include consultations, surgeries and basic dental treatments

- They have 24/7 customer service by phone and email with experienced consultants, doctors and experts

- They offer evacuation and repatriation service

- They offer medical support and pre-victory advice (vaccinations, preparation of a first aid kit)

What I don’t like about Foyer Global Health plans:

- Your most basic plan does not cover prenatal and postnatal care

HCCMIS is another provider that provides insurance for full-time students and scholarship holders who study away from home (along with usual travel insurance sales).

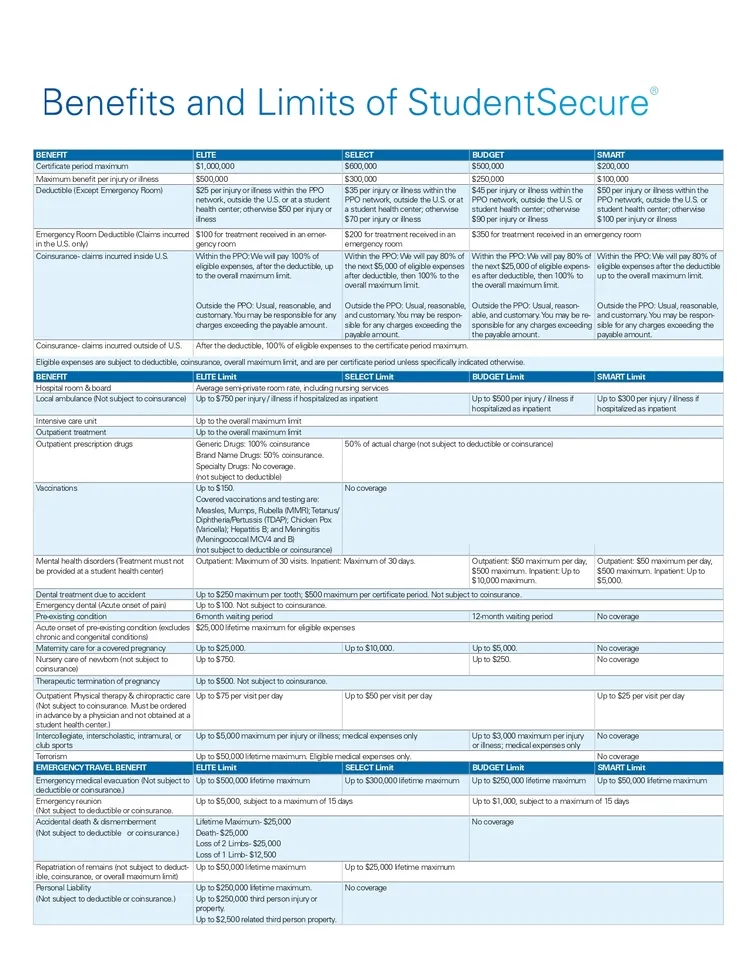

These are the 4 levels of student health insurance coverage they offer (everyone works very well for Mexico!):

StudentSecure Elite

- Offers the lowest franchises and the highest maximum coverage

- 6 months waiting period before a pre-existing condition can be covered

- Offers sports coverage for club/inter-national activities

- It covers personal responsibility

StudentSecure Select

- 6 months waiting period before a pre-existing condition can be covered

- Optional Crisis Response Pilot for Rescue, Your Personal Fees and Crisis Fees

StudentSecure Budget

- Coverage of pre-existing diseases begins 12 months after the purchase of insurance

- Benefits of medium level and higher deductible (for a lower monthly rate overall)

StudentSecure Smart

- Lowest cost plan (with the lowest corresponding benefits)

- Higher franchises of all plans

- Does not cover club sports

- Can only cover a pre-existing condition in its acute onset

Here is a comparison of the 4 HCC StudentSecure plans (click to view full chart):

What I like about HCCMIS’ StudentSecure plans:

- They offer emergency dental care (in case of accident) up to $250 per tooth and $500 maximum in the certification period

- They offer an economy plan if you pay the full amount in advance

- They are some of the most economical plans on this list

What I don’t like about HCCMIS’ StudentSecure plans:

- There is no coverage for pre-existing conditions on your Smart plan

- There is a 6 month waiting period for coverage of pre-existing conditions (even in your Elite plan)

- No vaccination coverage unless you get the Elite plan

- There is no coverage for maternity and nursery for newborns in the Smart plan

- Your low-cost plans can have high deductibles

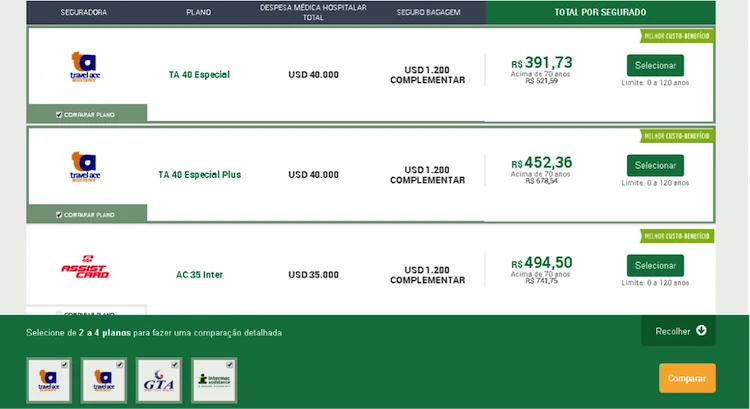

If you have a preference for Brazilian companies, Insurance Promo may be a good option for you.

This is a platform that aggregates several insurances of different companies, which can help in your choice of the plan that best suits your profile.

In addition, the service, clarification of doubts and payment is done directly with Promo Insurance, so it is not necessary to worry about international payments, service in other languages or occasional problems of dealing with a foreign company.

Just remember to confirm with your educational institution if they accept the student health insurance you choose on this platform. This way, you avoid any disorders.

What I like about the international health insurance of Insurance Promo:

- 24-hour national service

- The portal has filters that help when choosing the plan

- Intuitive interface with comparisons between planes

- Diverse international health insurance for students available

What I do not like in the international health insurance of Insurance Promo:

- In some plans, the price can vary on account of the current exchange rate

- The wide variety of options can make your choice confusing

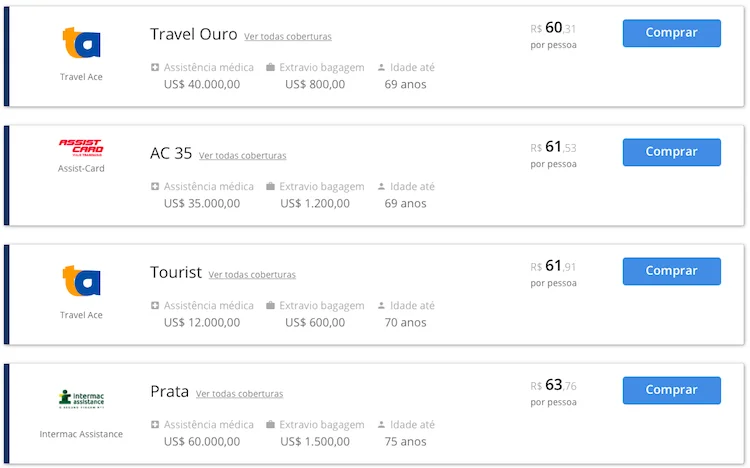

Real Seguros works very similarly to Promo Insurance, in it you can compare numerous insurance from different companies until you find the ideal for you.

Because it is a Brazilian company, all service channels are in Portuguese, which can help many people who do not have command of English.

Despite the similarity with the above option, here are some important differences below.

What I like about Real Seguros international health insurance:

- There are a wide variety of insurance options at fair prices

- Possibility of dental care coverage in emergency cases

- If there are no physical conditions to continue in Mexico, they cover transfers to Brazil

- Cover pharmaceutical expenses, as long as they are prescribed by a doctor

What I do not like in Real Seguros international health insurance:

- Do not offer pregnancy coverage and do not have maternity assistance

- Some of the available options does not cover pre-existing diseases

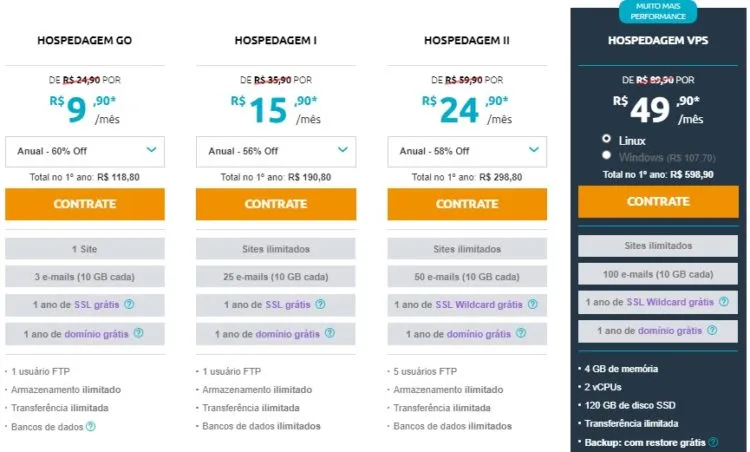

Comparative tables among the best health insurance for students/intercamists in Mexico

| IMG | Cigna Global | Foyer Global Health |   WorldTrips WorldTrips |   Global Underwriters |   Insurance Promo Insurance Promo |   Real Insurance Real Insurance | |

| Maximum medical coverage | $5,000,000 | Unlimited in Platinum plan | There are no limits on the plan. | $1,000,000 | $1,000,000 | Depends on the insurance contracted | Depends on the insurance contracted |

| Benefit for mental health | Not specified | Unlimited for up to 90 days | Included in all plans, with a 10-month waiting period | Outpatient: Max. of $50 per day, $500 being the limit added | Yes, but no service in Portuguese | Not specified | Not specified |

| Prescription of inpatient medications | 80% of expenses outside the network or 100% in the (US) network and internationally | Not specified | There is cover | For generic drugs: 100% coinsurance Branded drugs: 50% coinsurance Special Drugs: No Coverage | Yes I | There is cover | There is cover |

| Prescription of Medications in Ambulatory | 50% of the real costs 90 days maximum per dispensing. | Not specified | Not specified | For generic drugs: 100% coinsurance Branded drugs: 50% coinsurance Special Drugs: No Coverage | Yes I | Yes I | Yes I |

| Repatriation of the remains | $25,000, at most, or $5,000 for cremation | Optional | Optional | $50,000 or $5,000 for cremation | Maximum of $13,500 | Yes I | Yes, only in case of accidents |

| Evacuation in case of emergency | $50,000 | Optional | Optional | $10,000 | Yes, without limits | Not specified | Not specified |

| Hospital Room | Offered up to the average semi-private daily | Private room | Private room | Usual | Private room | Depends on the contracted plan | Depends on the contracted plan |

| Terrorism | $50,000 | Not specified | Not specified | $100,000 | |||

| Accidental Death and Dismemberment (AD & D) | principal sum of $25,000 that is not subject to deduction. | $25,000 for the principal participant; $10,000 for plan participating spouse; $5,000 for child participating in the plan; Aggregated limit of $250,000 for total number of insureds in the plan | Optional | $25,000 for the principal participant; $10,000 for plan participating spouse; $5,000 for child participating in the plan; Aggregated limit of $250,000 for total number of insureds in the plan | $13,500, only for the Care Plus plan | There is cover | There is cover |

| Dental Emergency | $500 per period of coverage per injury | Optional | Optional | $2,500 | Yes, but must be paid on a separate plan | Yes I | Yes, in cases of emergency |

| Maternity | Covered only in the platinum plane | On the Platinum plan, $14,000/ 11,000 / ?9,000 | Only on Special and Exclusive plan | Within the U.S.: In the PPO network, 80% up to the $25,000 limit. Outside PPO: 60% to the limit of $25,000 Outside the U.S.: 80% until it reaches the $25,000 limit. Reduced benefits 25% if pregnancy is not informed within the first 90 days | Covered in all plans | There are plans with full coverage | Yes, for emergencies |

| Pre-existing conditions | maximum limit of $1,500 after a 12 month waiting period | On the Platinum plan, $39,000/ $30,500 / ?25,000 | There is cover | $250,000 limit per plan | Not specified | It has no coverage | There is cover |

| Intensive Care Unit (ICU) | Company pays 100% after the franchise is fulfilled | On the Platinum plan, completely covers | There is cover | $50,000 | Yes, in all plans | There is cover | There is cover |

| Vaccines | Not specified | Optional | Only on Special and Exclusive plan | $200 I’m a | Yes, but you need to hire a separate plan | Not specified | Not specified |

| Routine care for newborns | Not specified | Optional | Only on Special and Exclusive plan | $750 per newborn | Yes, but you need to hire a separate plan | Not to | Not to |

Worldwide Medical Insurance/ Comparison Chart

Part of the table is courtesy of Tokio Marine HCC*

Note: This table is for informational purposes only and is subject to change. It was correct at the time I wrote it, but check each company’s website for up-to-date information.

3 International Health Insurance Companies that can also be used by International Students in Mexico

The two companies I will mention below do not offer health insurance specifically for students abroad. That said, they offer international health insurance that (most likely) will be accepted by their school or university as proof of coverage.

So, my advice to you is that you ask a quote for these two companies below and compare it with the quote you got from the companies listed above. If you find that one of these two companies offers good coverage at a lower price than the other options, check with your Canadian school or university if they accept this type of policy.

If they accept, this is a great chance to save money before venturing into their new home!

Global Underwriters offers international health insurance plans for a wide range of travellers, including exchange students and international students abroad.

When it comes to GU plans, I recommend the Diplomat Long Term and Diplomat International for international students in Mexico.

What I like about Global Underwriters plans:

- His student plans have coverage for medical evacuations, emergency dentistry and repatriation of remains

- Diplomat Long Term and Diplomat International plans offer coverage of up to $1,000,000

- They offer coverage and assistance in case of loss of luggage and travel interruptions

- They have 24/7 customer service

What I don’t like about Global Underwriters plans:

- The Diplomat International plan does not cover Covid-19

- The Diplomat Long Term plan does not cater to students residing in Australia and Iran, as well as in New York, Maryland, South Dakota (although this is not a problem for you if you have moved to MéxicoMexico!)

- Your plans may be a little more expensive than others on this list

– Aetna

Aetna is a recognized company in the area of health insurance.

A good advantage of Aetna is that their plans are really flexible (you can customize based on what is needed for you), and they have very good customer service (as far as insurers) are concerned.

What I like about Aetna’s international health insurance:

- They have been in the health insurance industry for 5 decades

- They offer flexible and customized plans

- They have specialized service 24 hours on the seven days of the week

- Most of its plans offer coverage for emergency evacuations, cancer treatments, repatriation and hospitalizations

- They are an insurer who has won awards such as “Health Insurer of the Year” and “Best International Private Health Insurance Provider”

- They have an app that encourages customers to maintain healthier habits with a points and prize system

What I don’t like about Aetna’s international health insurance:

- Their website is not very clear about the exact coverage of some of their plans

- They don’t offer any kind of travel insurance plan

– Geoblue

Geoblue is another great option if you are looking for a health insurance policy to cover you while you study in Mexico.

What I like about Geoblue International Health Insurance:

- Your plans are very adaptable and flexible, based on exactly what you need

- They have 24/7 customer service

- Some of his plans cover extras like evacuation, preventive medical appointments and maternity care

- You can add ophthalmology and dentistry services

- The Xplorer plan does not have maximum medical coverage, covers extreme sports, does not charge franchises for standard services and has no cancellation fees

What I don’t like about Geoblue’s international health insurance:

- They do not serve residents of New York and Washington (although this may not be a problem if you move your official residence to Mexico)

- You have to contact an insurance broker and talk to him in person to get an exact quote (which is very boring)

For what types of courses, can foreign students apply for Mexico and how?

The higher education system in Mexico is similar to that of the US and Europe, being one of the best in the world.

Mexico has more than 60 institutions among the QS Latin America University Rankings and 14 institutions among the QS World University Rankings, the second country in Latin America with the most universities highlighted.

The highest-ranked institute is the Universidad Nacional Autónoma de México (UNAM), a public university with a student population of more than 350,000 spread across several campuses throughout the country. The main campus, located in the University of Mexico City, became a UNESCO World Heritage Site in 2007.

You can apply for various types of courses, such as bachelor’s, master’s, MBA or PhD! Entries depend on the rules of each institution. You can take a look at this list of best courses to study in Mexico and how to make their respective applications!

How to apply for a student visa in Mexico?

To apply for a student visa, you will need:

1. Visa form (front and back, on a page) with recent photography, color 3-4 and white background).

2. Original and copy of the current passport.

3. Letter of original acceptance of the educational institution in Mexico with an identification copy of the person who signs the letter and specifying:

Thes, the s. the full name of the applicant;

B. B. Level, degree and study area that the candidate intends to carry out;

Name of course in which you have been accepted;

d.. d. Start and end date of the course;

e.. e.. registration cost for the course; and

f.f. Identification data of the educational institution.

4. 4. Original and copy of the bank statements of the last three months, cheques of the last three months or original of the letter proving that the interested party will receive a scholarship.

NOTE: Economic solvency can be proven by parents, provided that the student is under 25 years of age and proves the link with the original and copy of the birth certificate.

In a short…

Again, here are the 7 best and cheapest health insurance policies for international students in Mexico:

- Student Health Advantage from IMG

- International health insurance for Cigna Global students

- Now Health International

- Foyer Global Health

- StudentSecure Insurance from HCCMIS

- Insurance Promo

- Real Insurance

Concluding

As you prepare for your time as an international student in Mexico, make sure that health insurance is not a detail you forget.

After all, you may not be able to enroll in school without him… and you don’t want to be stuck paying the medical expenses out of his own pocket!

If you still have any questions about these options for travel insurance for students in Mexico (or about moving abroad in general), let me know in the comment area below and I will be happy to help!

Sign up for our newsletter and stay up to date with exclusive news

that can transform your routine!

Warning: Undefined array key "title" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 12

Warning: Undefined array key "title_tag" in /home/storelat/public_html/wp-content/plugins/link-whisper-premium/templates/frontend/related-posts.php on line 13