When I first heard about the 3 Month Salary Rule, I was both intrigued and skeptical. The idea that one could determine how much to spend on an engagement ring based on a simple formula seemed almost too good to be true. Yet, as I delved deeper into the concept, I realized that it not only encompasses the traditional wisdom surrounding engagement rings but also offers a broader lesson in financial planning and personal value assessment. In this article, I will share my insights on the 3 Month Salary Rule, reveal its secrets, and help you enhance your financial savvy.

Understanding the 3 Month Salary Rule

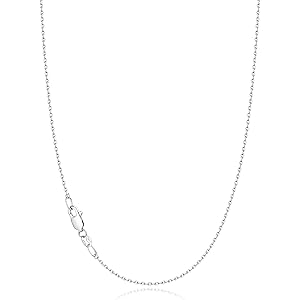

The 3 Month Salary Rule is a guideline that suggests individuals should spend an amount equivalent to three months of their salary on an engagement ring. This rule has been popularized through marketing campaigns and cultural norms, but what does it really mean? Is it a sensible approach to budgeting for one of the most significant purchases in your life?

To answer these questions, let’s break down the origins and implications of this rule.

The Origins of the 3 Month Salary Rule

The concept can be traced back to the late 20th century, heavily promoted by diamond companies like De Beers. Their iconic slogan, “A Diamond is Forever,” aimed to instill the idea that diamonds, particularly engagement rings, symbolize eternal love and commitment. By suggesting that spending three months’ salary was the standard, they effectively shaped consumer behavior and expectations around engagement rings.

Is the 3 Month Salary Rule Still Relevant?

As I contemplated this question, I realized that relevance is subjective. While many people still adhere to this guideline, others are questioning its validity in today’s financial landscape. Factors such as personal circumstances, financial goals, and societal changes have led to a more nuanced understanding of spending on engagement rings.

Examining the Financial Impact

Before making any significant financial decision, it’s crucial to understand the potential impact on your overall financial health. Here are some key considerations:

- Debt and Financial Obligations: If you have existing debts, spending a large sum on an engagement ring might not be the best decision. Prioritizing financial stability should come first.

- Income Variability: Your salary might fluctuate from month to month. Consider whether basing a purchase on an average or a peak salary is practical.

- Future Financial Goals: Think about your long-term financial plans. How does purchasing an expensive ring align with your goals, like buying a house or saving for retirement?

Alternative Approaches to Budgeting for an Engagement Ring

As I reflected on the 3 Month Salary Rule, I found that there are alternative approaches to budgeting for an engagement ring. Here are some methods I discovered:

- Personal Value Assessment: Determine what the ring means to you and your partner. Is it a symbol of love, or does it carry more sentimental value? This evaluation can guide your spending.

- Set a Budget: Instead of adhering to a specific rule, create a budget that considers your financial situation and future goals. This personalized approach can help you avoid overspending.

- Consider Alternatives: Explore different types of rings or gemstones that might be more affordable. Lab-grown diamonds, for example, are often less expensive than mined diamonds.

Case Studies: Real-Life Examples

To further illustrate the implications of the 3 Month Salary Rule, let me share a couple of real-life examples I came across.

Case Study 1: The Traditionalist

John, a 30-year-old accountant, followed the 3 Month Salary Rule without question. Earning $60,000 a year, he spent $15,000 on an engagement ring. While he believed he was making a grand gesture, he later found himself struggling to pay off credit card debt and felt the weight of financial stress. His experience highlights the importance of assessing one’s personal financial situation rather than blindly following societal norms.

Case Study 2: The Pragmatist

In contrast, Sarah, a 28-year-old teacher, decided to set a budget based on her current financial situation. Earning $40,000 a year, she spent $5,000 on a beautiful yet simple ring that fit her budget perfectly. By doing so, she avoided debt and was able to save for their future home. Sarah’s story showcases the value of considering personal circumstances over external expectations.

Psychological Aspects of Spending

Spending is not just a financial decision; it’s often an emotional one as well. I found it fascinating to explore the psychological factors that influence our spending habits, especially regarding significant purchases like engagement rings.

Emotional Significance

Engagement rings carry immense emotional weight. They symbolize love, commitment, and the promise of a future together. This emotional significance can sometimes lead us to overspend, believing that a more expensive ring equates to deeper love or commitment.

Social Pressure

Social norms can also create pressure to conform to certain spending standards. The fear of judgment from peers or family can lead individuals to make financial decisions that are not aligned with their values or circumstances.

How to Boost Your Financial Savvy

Now that we’ve explored the 3 Month Salary Rule and its implications, let’s shift our focus to how we can boost our financial savvy. Here are some strategies I find helpful:

- Educate Yourself: Knowledge is power. Invest time in learning about personal finance, budgeting, and investment strategies. There are numerous resources available, from books to online courses.

- Create a Financial Plan: Outline your financial goals, including savings, investments, and major purchases. Having a clear plan can guide your spending decisions.

- Track Your Spending: Use budgeting apps or tools to monitor your expenses. Understanding where your money goes can help you make informed decisions.

- Seek Professional Advice: If you feel overwhelmed, consider consulting a financial advisor. They can provide personalized guidance based on your circumstances.

The Importance of Communication in Relationships

When it comes to significant purchases like engagement rings, communication between partners is crucial. Discussing financial expectations, values, and spending habits can help prevent misunderstandings and ensure both parties are on the same page.

Setting Expectations

Before making a purchase, it’s essential to have an open dialogue about what you both envision for the future. This conversation can set the tone for your financial journey together and establish a foundation of trust.

Compromise and Collaboration

Relationships often require compromise. If one partner has a particular vision for an engagement ring that exceeds the budget, discussing alternatives or adjusting expectations can lead to a mutually satisfying decision.

Conclusion

In conclusion, the 3 Month Salary Rule serves as a reminder of the importance of evaluating personal circumstances rather than adhering to societal norms. By understanding the financial impact of our decisions, exploring alternative budgeting approaches, and enhancing our financial savvy, we can make informed choices that align with our values and goals.

Ultimately, whether you choose to follow the 3 Month Salary Rule or chart your own path, the key takeaway is this: financial well-being is about making choices that support your life goals and values. As I reflect on my journey, I encourage you to prioritize thoughtful spending and open communication in your relationships.

FAQs

1. Is the 3 Month Salary Rule a hard and fast rule?

No, it is more of a guideline. Individuals should consider their unique financial situations and values when deciding how much to spend on an engagement ring.

2. What if I can’t afford to spend three months’ salary on a ring?

It’s perfectly acceptable to spend less. Focus on what feels right for you and your partner rather than adhering to societal expectations.

3. Are there alternatives to traditional diamond rings?

Yes, lab-grown diamonds, colored gemstones, and other materials can be beautiful and more affordable alternatives.

4. How can I communicate my budget with my partner?

Have an open and honest conversation about your financial situation, values, and expectations regarding the engagement ring.

If you found this article insightful, I encourage you to sign up for our newsletter for more tips on financial literacy and relationship advice! Together, we can navigate the complexities of financial decision-making and build a brighter financial future.